A new bill being introduced by Sens. Kirsten Gillibrand (D-N.Y.) and Josh Hawley (R-Mo.) would bar executive branch officials, members of Congress and their families from owning or trading stocks in individual companies.

Efforts to curb or ban stock trading by members of Congress have gained momentum in the past few years, with a slew of bills on the topic, as well as major investigations by the New York Times and Wall Street Journal.

Letting members play the stock market creates conflicts of interest that are an invitation to corruption. This is particularly troubling when these deals involve members who have decision making power over spending on the Pentagon, intelligence, and homeland security. America’s security should not be for sale.

Support for higher Pentagon budgets can lift share values of members invested in weapons industry stocks. These votes for Pentagon increases may be based on other considerations, but the key point is that stock trading creates the opportunity for self-dealing and profiteering on the part of key members of Congress. The temptation for corrupt decision making is itself a serious problem. Even the appearance of conflicts of interest undercuts public trust in the budget decision making process.

Investigations by major news outlets and non-governmental organizations have identified at least 25 members of key national security committees with investments in arms industry stocks, in firms ranging from top-ranked contractors like Lockheed Martin and Raytheon to lesser known companies like Huntington Ingalls Industries and L3 Harris.

Examples include Sen. Tommy Tuberville (R-Ala.), a member of the Senate Armed Services Committee, and a prolific stock trader. Tuberville is best known for putting a hold on top military nominations to protest the Pentagon policy that covers abortion-related travel expenses for service members based in states with restrictive reproductive healthcare laws. The Pentagon estimates that Tuberville’s actions could impact 650 positions by the end of this year.

Meanwhile, Tuberville reported owning hundreds of thousands of shares in Honeywell, Lockheed Martin, General Electric, Raytheon, and General Dynamics since 2020. Additionally, he sold his shares of Microsoft about two weeks before it became public that the company’s $10 billion contract with the Pentagon was canceled. He also bet against a Taiwanese company whose stock is often affected by U.S.-China relations, as RS’s Connor Echols reported earlier this year.

Another SASC member, Sen. Jacky Rosen (D-Nev.) reported co-owning $110,000 worth of shares in General Electric with her husband. Rep. John Rutherford (R-Fla.) bought shares in Raytheon on February 24, 2022 — the day Russia invaded Ukraine. Rutherford sits on the House Appropriations homeland security subcommittee. Rep. Josh Gottheimer (D-N.J.), who sits on the House Permanent Select Committee on Intelligence (and is the ranking member of the National Security Agency and Cyber subcommittee) has traded millions in Microsoft shares — the latest example being his purchase of three $1-5 million blocs of shares on May 15 and 16 this year.

There are a number of cases in which members have failed to comply even with the weak rules that are now on the books, which involve periodic reporting on stock deals.

As the Project on Government Oversight has pointed out, the best way to eliminate the potential conflicts of interest inherent in congressional stock ownership is to institute a comprehensive ban on trading in stocks by all members of Congress as well as immediate family members and senior staff — with no loopholes, and no complex work arounds. POGO elaborated on the features of a strong stock trading ban in congressional testimony last year. Many recent legislative proposals fall short of this standard.

Stock trading is just one potential financial incentive for members of armed services, defense appropriations, intelligence, and homeland security committees to jack up military spending. Campaign contributions, arms-related jobs in a member’s state or district, and lobbying by former colleagues also exert pressure to up the Pentagon’s already enormous budget.

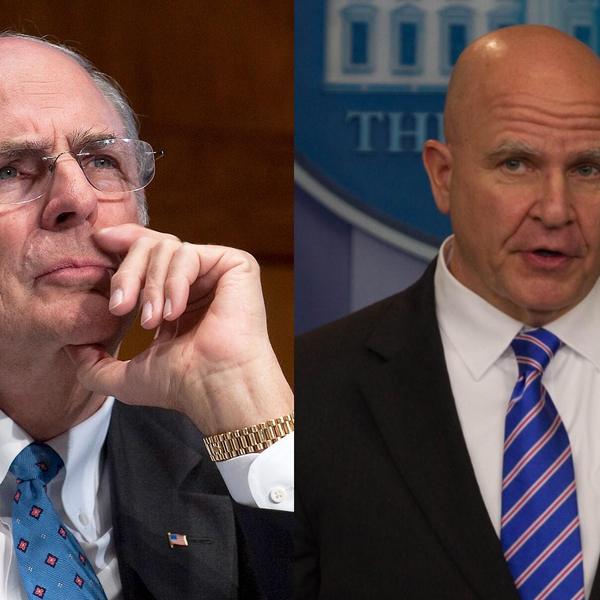

For example, Rep. Mike Rogers (R-Ala.), chairman of the House Armed Services Committee, was the top recipient of defense industry campaign contributions during the 2022 midterm election cycle, getting over $511,000 in donations from weapons makers. The aforementioned Sen. Tuberville has received over $244,000 in arms industry contributions since 2017.

Meanwhile, in the past two years — prior to this year’s debt ceiling deal — Congress added $25 billion and $45 billion to the Pentagon budget, respectively, beyond what the department even asked for. Much of this funding was for projects in the districts or states of key members. And in many cases the member in question even issued a press release bragging about the items they added to the budget. These statements are almost always accompanied by a perfunctory argument that the additional spending is necessary for national security, but in many cases these protestations are just a smoke screen to hide the fact that these decisions serve special interests, not the national interest.

Adding unnecessary weapons to the budget for economic and political reasons is a form of legalized corruption that wastes scarce taxpayer dollars and undermines the possibility of aligning arms spending with a more sound defense posture.

Stock trading is just one piece of a larger problem of undue pressures on Congress to “go big” on Pentagon spending. But eliminating it would be a step in the right direction that might encourage initiatives to reform other practices that stand in the way of crafting a more realistic Pentagon budget in service of a more coherent defense strategy.

- Surprise, Wall Street ignores own rules on weapons investing in Gaza | Responsible Statecraft ›

- Will stock trade ban curtail DOD budget corruption? | Responsible Statecraft ›

- RTX (ex-Raytheon) busted for ‘extraordinary’ corruption | Responsible Statecraft ›

- Top defense stock traders in Congress in 2024 | Responsible Statecraft ›