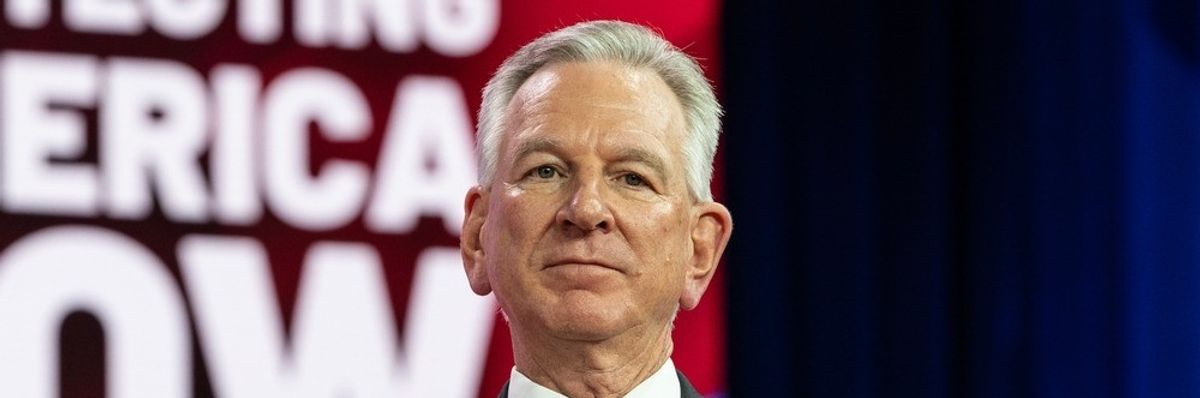

Sen. Tommy Tuberville (R-Ala.), a prominent China hawk and member of the Senate Armed Services Committee, placed a financial bet worth up to $45,000 against a Taiwanese company whose stock is often affected by U.S.-China tensions, according to a pair of recent financial disclosures.

Last November, Tuberville purchased two put options on the Taiwan Semiconductor Manufacturing Company (TSMC) that he could exercise if the stock fell below $75 per share, which was then valued at $82. He doubled down on the bet on March 27, when the share price had risen to $90. As of Thursday, it had fallen back to $83.50.

If TSMC stock drops to $60 per share — as it did last October amid an increase in U.S.-China tensions and headwinds in the semiconductor industry — Tuberville could exercise the option and net a payout of as much as $150,000. Notably, the lawmaker also recently purchased up to $250,000 of stock in Intel, a leading TSMC competitor.

The bet against TSMC raises serious ethical concerns, according to Liz Hempowicz of the Project on Government Oversight.

“This does look like a clear conflict [of interest] to me,” said Hempowicz, who has testified about congressional trading before the Committee on House Administration. “But it’s really hard to say just how big of a conflict, and that is part of the problem itself, especially for members on these committees that conduct so much business behind closed doors.”

The exact value of Tuberville’s stock options is unclear. He reported three total purchases with a combined value of between $3,000 and $45,000.

TSMC is the world’s most valuable semiconductor manufacturer, with a market capitalization in excess of $400 billion. Its products are crucial for multinational giants like Apple, Sony and Nvidia, among others.

The company is considered so crucial to Taiwan’s economy that it has become customary for U.S. officials to meet with its leaders during trips to the island. During then-Speaker Nancy Pelosi’s controversial visit last year, she sat down with TSMC founder Morris Chang and Chairman Mark Liu.

Tuberville himself stopped by TSMC during a congressional trip in late 2021. Chinese officials were so enraged by the visit to Taiwan that they privately urged the lawmakers to cancel it, arguing that such a move would undermine America’s ‘One China’ policy.

The former Auburn University football coach has made hawkish policy toward China one of his signature issues since joining Congress in 2021. Tuberville co-sponsored a bill last year that would ban the Chinese Communist Party from purchasing land in the United States, and he has frequently hyped up the threat that China’s military poses to America.

TSMC’s work has been directly affected by U.S.-China tensions, as Liu explained last October.

“The U.S.-China trade conflict and the escalation of cross-Strait tensions have brought more serious challenges to all industries, including the semiconductor industry,” Liu said at a gathering of leaders in the Taiwanese semiconductor industry.

Continued tensions have also caused some major investors to reduce their exposure to TSMC. Warren Buffett disclosed in February that he had dumped 86 percent of his firm’s holdings in the company and cited geopolitical concerns as “a consideration” in the decision.

Tuberville has been a prominent player in the debate over whether members of Congress should be banned from trading individual stocks. In February of last year, the lawmaker called plans for a ban “ridiculous” and argued such a move would reduce the number of people interested in running for office.

He previously raised eyebrows with purchases of cattle, wheat, and corn futures — an apparent conflict given Tuberville’s seat on the Senate Agriculture Committee — as well as a sale of a Microsoft stock option just two weeks before the computer giant lost out on a $10 billion contract with the Pentagon.

In an email to RS, Tuberville spokesperson Steven Stafford wrote that the senator “has long had financial advisors who actively manage his portfolio without his day-to-day involvement.”

“I don’t limit them to anything, what they can do, what they can’t do,” Tuberville told the New York Times late last year. “I give them money, say to them: ‘I’m in public service now; you do it. Don’t lose it all!’”

But Hempowicz argues that such an approach falls short given that it asks the public to simply take the senator at his word. “There's nothing enforcing that they are not having those kinds of conversations” with their financial advisors, she noted.

Some members, like Sens. Jon Ossoff (D-Ga.) and John Hoeven (R-N.D.), have voluntarily chosen to place their holdings in a blind trust, which legally prevents them from interacting with the person making investment decisions.

Unlike the judicial and executive branches, Congress places nearly no restrictions on the ability of its members to trade individual stocks, though a 2012 law forces lawmakers to publicly disclose trades.

Some enterprising investors have taken advantage of disclosure rules to play the stock market like a member of Congress. While legislators’ trading doesn’t always beat the markets, one model that follows lawmakers’ moves yielded a six percent return over the past year as of Thursday — nine points better than the commonly used S&P 500 Index, which fell by three percent over the same period.

As Hempowicz noted, years of controversies over suspicious trades have helped create broad public support for restrictions on how members of Congress engage with the stock market. A June 2022 poll found that 70 percent of likely voters — including large majorities of both Democrats and Republicans — want to ban lawmakers from trading individual stocks.

“We are going to continue to get examples of members of Congress engaging in financial behavior that raises eyebrows at the very least,” Hempowicz said. “The public will continue to be outraged and continue to ask for things to be better.”