As the scorching summer season approaches, Egypt finds itself once again in the throes of an uncomfortable ritual: the annual scramble for natural gas.

Recent reports paint a concerning picture of what's to come, industrial gas supplies to vital sectors like petrochemicals and fertilizers have been drastically cut, some by as much as 50 percent. The proximate cause? Routine maintenance at Israel’s Leviathan mega-field, leading to a significant drop in imports.

But this is merely the latest symptom of a deeper, more chronic ailment. Egypt, once lauded as a rising energy hub, has fallen into a perilous trap of dependence, its national security and foreign policy options increasingly constrained by an awkward reliance on Israeli gas.

For years, the Egyptian government assured its populace and the world of an impending energy bonanza. The discovery of the gargantuan Zohr gas field in 2015, hailed as the largest in the Mediterranean, was presented as the dawn of a new era. By 2018, when Zohr began production, President Abdel Fattah el-Sisi declared that Egypt had "scored a goal," promising self-sufficiency and even the transformation into a regional gas exporter. The vision was that Egypt, once an importer, would leverage its strategic location and liquefaction plants to become a vital conduit for Eastern Mediterranean gas flowing to Europe.

Billions were poured into new power stations, further solidifying the nation's reliance on gas for electricity generation, which today accounts for a staggering 60 percent of its total consumption.

However, the dream of abundant domestic gas has, like so many ambitious projects in the region, begun to wither. Just three years after its peak, Zohr’s output alarmingly declined. Experts now suggest Zohr’s recoverable reserves may be far less than initially estimated. Furthermore, as Egyptian energy expert Khaled Fouad notes, the political leadership's "impatience" to accelerate production for quick economic returns — especially to capitalize on European demand amid the Russia-Ukraine war — led to technical problems and damage to the wells.

Compounding this internal mismanagement is Egypt’s chronic foreign currency crunch, and the multi-billion dollars in arrears it owes to international oil and gas companies.

These financial troubles have, in turn, curtailed crucial investments in new exploration and the maintenance of existing fields, effectively strangling domestic production. Consequently, by 2023, Egypt had dramatically reverted to being a net natural gas importer, a precipitous swing of over $10 billion from its brief surplus just a year prior. And in 2024, Israeli gas accounted for a dominant 72 percent of Egypt's total gas imports. This growing dependence has, perhaps inevitably, transformed a commercial transaction into a formidable tool of leverage.

The true vulnerability of this arrangement was laid bare following the outbreak of the war between Israel and Hamas in October 2023. Israel, citing "security concerns," abruptly forced Chevron, the field’s operator, to shut down production at its Tamar field, causing imports to Egypt to plummet. This marked the first of several disruptions, with another significant cut occurring in May of this year. While officially attributed to maintenance, Egyptian analysts widely interpret these interruptions, coinciding with heightened political tensions due to the Gaza war, as a form of political "blackmail."

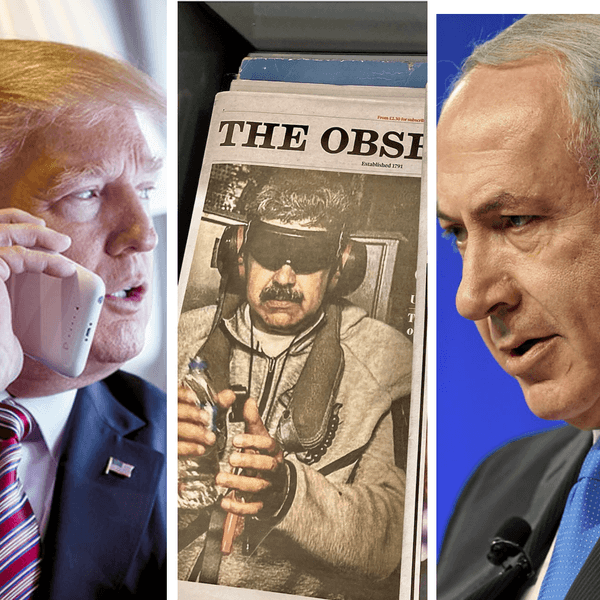

This energy dependence has profoundly constrained Egypt's national security and foreign policy calculus, particularly concerning the Gaza conflict. For Cairo, the war next door poses an existential threat due to persistent calls from figures like U.S. President Donald Trump and far-right elements in the Israeli government, for the displacement of Gaza’s population into Egypt's Sinai Peninsula.

This prospect, a "red line" for Egypt, is fiercely resisted by Cairo, which views Israel's active push of Gaza's inhabitants towards the Egyptian border as a calculated attempt to extinguish the possibility of a future Palestinian state. In addition to the political fallout for Cairo if realized, such a move would displace upwards of a million Gazans, including Hamas militants, onto Egyptian soil, which would in turn transform Sinai back into a volatile conflict zone.

The region was only recently stabilized after a costly, over decade-long campaign against extremist militants, a campaign in which Hamas, for a period, even provided clandestine aid to some of these groups. The potential for renewed instability could far exceed its previous peak.

In addition to exacerbating security challenges, a mass displacement will also dramatically spike Egypt's domestic energy demands, already strained by the sudden influx of over 1.2 million Sudanese refugees into Egypt since the outbreak of war in Sudan in April 2023, according to Egyptian government estimates.

Furthermore, Egypt's economic and energy vulnerability limits its room for maneuver. The absence of a new Egyptian ambassador to Tel Aviv, a symbolic gesture of protest against Israel's Gaza offensive, masks the deeper, uncomfortable truth that Cairo’s ability to exert meaningful influence in the ongoing tragedy is severely hampered by its reliance on Israeli energy.

Confronted by these immense pressures, Egypt cannot afford to provoke a direct confrontation that could jeopardize its national security, energy supplies, or critical foreign aid, which has historically been disbursed by the U.S. in direct support of the 1979 peace treaty with Israel. Instead, Cairo is relying on a combination of military posturing, diplomatic initiatives, and regional alliances to push back against Israeli actions — while being careful not to cross a line that would trigger severe retaliation or broader destabilization.

Faced with this awkward and increasingly untenable predicament, Egypt is now scrambling for alternatives, embarking on a multi-pronged outreach strategy that underscores the desperation of its energy crunch. Capitalizing on its thawing of relations with Turkey, President el-Sisi’s visit to Ankara in September 2024, followed by Turkish President Recep Tayyip Erdogan's reciprocal trip to Cairo in December of the same year, cemented the rapprochement with agreements on energy cooperation, among other areas of shared interest.

Crucially, Egypt has inked a deal for the long-term lease of a Turkish Floating Storage and Regasification Unit (FSRU) from Höegh Evi Ltd., signaling a sustained reliance on LNG imports for at least a decade. In parallel, Cairo is in advanced talks with Qatar, a global gas giant, for long-term supply contracts.

While these external maneuvers are underway, Egypt is simultaneously intensifying domestic exploration efforts. Minister of Petroleum Karim Badawi recently announced the drilling of 75 wells and 40 new discoveries in the past year, estimated to hold significant, albeit relatively modest, reserves.

However, substantial discoveries take years — typically three to five, especially for offshore fields — to develop and connect to the grid. Renewable energy, championed by Egypt with ambitious targets to meet 42 percent of its electricity demands from green sources by 2035, offers a crucial long-term pathway. But, the upfront investment is immense, and the immediate impact on bridging the current energy deficit is negligible. All these efforts, while necessary, are long-term fixes, offering little respite for the immediate summers to come.

The reliance on Israeli gas, initially framed as an economic boon, has proven to be a strategic liability, eroding Egypt's foreign policy autonomy and tethering its domestic stability to external forces. Achieving true energy self-sufficiency or, at the very least, a diversified and resilient energy mix, will require years of sustained investment, prudent resource management, and a strategic vision that prioritizes national security over short-term economic expediency.

Until then, Egypt remains caught in the current, its fate disproportionately swayed by the flow, or interruption, of gas from its neighbor across the Sinai.

- Why Egypt can't and won't open the floodgates from Gaza ›

- Will Egypt suspend the Camp David Accords? ›

- Israel testing Egypt's 'weak hand' in Gaza conflict ›

- Are Iran and Egypt relations on the cusp of a 'seismic shift'? | Responsible Statecraft ›

- Why Egypt can't criticize Israel for at least another two decades | Responsible Statecraft ›

- Can Egypt really stop Israel from attacking Iran again? | Responsible Statecraft ›

- Think a $35B gas deal will thaw Egypt toward Israel? Not so fast. | Responsible Statecraft ›