The New York Times reported this week that 97 members of Congress “bought or sold stocks, bonds, or other financial assets that intersected with their congressional work or reported similar transactions by their spouse or a dependent child” between 2019 and 2021. With more than 3,700 such trades in those three years alone, the investigation reveals potential conflicts of interest in nearly every area of policymaking.

Defense policy is no different. At least 25 members sat on committees that shape national security policy while simultaneously trading financial assets in companies that could create competing interests with their work, such as defense stock. With a near-even party split, Democrats and Republicans may have found a rare instance of common ground.

The majority of these members sat on the House and Senate Armed Services Committees — the committees responsible for the budget and oversight of the Department of Defense.

The list includes the former chair of the Senate Armed Services Committee, James Inhofe (R-Okla.), who bought and sold shares of technology companies as they fought over a $10 billion cloud computing contract with the Pentagon, which eventually went to Microsoft. When the Pentagon later decided to cancel the contract, House Armed Services Committee member Rep. Pat Fallon (R-Texas) sold up to $250,000 worth of Microsoft stock two weeks before it was publically announced. Fallon served on the subcommittee which oversaw the deal, though a spokesperson said at the time that he had “absolutely no prior knowledge the Pentagon intended to cancel” the contract.

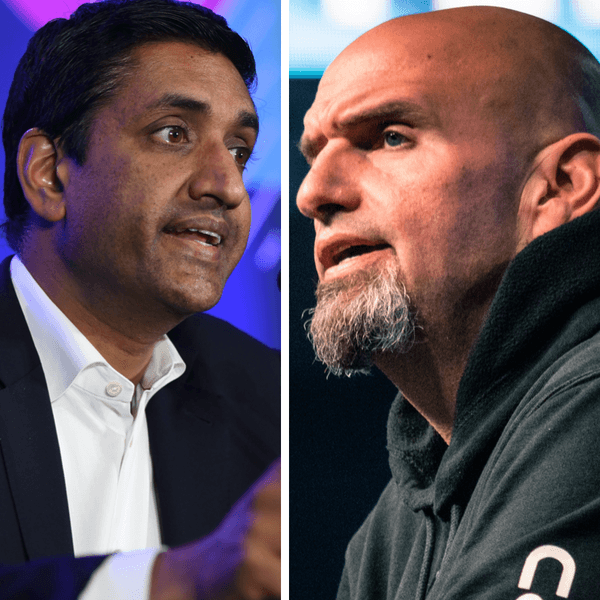

It also includes Rep. Ro Khanna (D-Calif.), who reported more trades than any other member of Congress. Though they were “made by trusts in the name of his wife and young children,” these trades spanned all of the top five weapons contractors — Lockheed Martin, Raytheon, Boeing, General Dynamics, Northrop Grumman — which could conflict with his role as a member of the House Armed Services Committee. Khanna has been an opponent of overspending on the Pentagon, an indication that there is not always a straight line between stock ownership and votes on the budget. But that is decidedly not the case with many other members who cash in on defense stocks while wielding power in favor of bigger defense spending.

Members of the Foreign Affairs, Homeland Security, Intelligence, and Appropriations committees also reported trades that could constitute a conflict of interest.

John Rutherford (R-Fla.), for instance, traded Lockheed Martin, Microsoft, and BAE Systems stock while sitting on the House Appropriations subcommittee responsible for determining the Department of Homeland Security’s funding. All three of those companies have been awarded contracts with the Department of Homeland Security. Rutherford then bought Raytheon stock the day that Russia invaded Ukraine, a company that has also been awarded contracts by the Department of Homeland Security.

The New York Times analysis defines a potential conflict of interest fairly narrowly, only focusing on stock trades in companies relevant to committee assignments. Given the daunting task of assembling such a comprehensive list, it is also limited to that three-year span. As a result, it doesn’t include instances like Earl Blumenauer (D-Ore.) picking up Raytheon stock the day of Russia’s invasion of Ukraine, or Marjorie Taylor Greene (R-Ga.) buying Lockheed Martin stock the day before. By the Times’ own admission, “the analysis is surely an undercount.”

Though all of these lawmakers deny any impropriety, the capacity for competing interests is clear; Congress continues to approve defense budgets beyond what even the Pentagon even asks for, more than half of which goes to private contractors such as Lockheed Martin and Raytheon, which could in turn privately benefit members of Congress invested in those stocks.

This could create a perverse incentive structure when taking into account that when global tensions rise, defense stocks tend to follow suit. War is often good for defense companies' bottom line; Jon Schwartz noted in the Intercept last year that “defense stocks outperformed the stock market overall by 58 percent during the Afghanistan War.” Some members of the defense industry even acknowledge this connection, as Raytheon CEO Greg Hayes did during an earnings call earlier this year:

“We are seeing, I would say, opportunities for international sales. We just have to look to last week where we saw the drone attack in the UAE, which have attacked some of their other facilities. And of course, the tensions in Eastern Europe, the tensions in the South China Sea, all of those things are putting pressure on some of the defense spending over there. So I fully expect we're going to see some benefit from it.”

Pressure is mounting for Congress to seriously consider self-regulation of stock trading. Seventy percent of Americans support banning lawmakers from trading stocks, including a majority of both Democratic and Republican voters. To date, at least six different bills have been proposed to limit the ability of members of Congress to trade stock.

Despite the popularity of these measures, self-regulation is always a tall order. Senator Tommy Tuberville (R-Ala.) went on record saying that limiting lawmakers’ ability to trade stocks would be “ridiculous” and that “it would really cut back on the amount of people that would want to come up here and serve.” Tuberville himself traded stock of major defense contractors such as Honeywell and General Dynamics while sitting on the Senate Armed Services Committee.

Confidence in Congress sits in the single digits, as overinvestment in the Pentagon has come at the underinvestment in healthcare, education, and addressing the climate crisis. Even if lawmakers defend their trades as routine, the goal should be to eliminate both the appearance and reality of conflict in setting national security priorities.