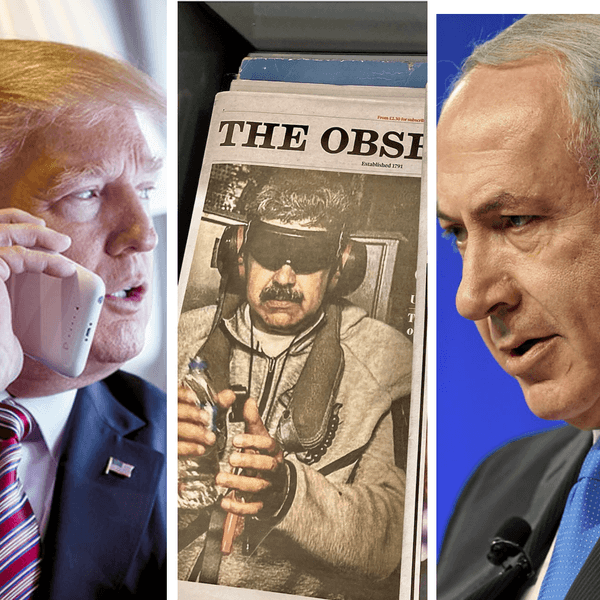

Negotiations to restore the Joint Comprehensive Plan of Action (JPCOA) are expected to resume in August following the inauguration of Iran’s new president, Ebrahim Raisi. The incoming administration will likely include figures who criticised current president Hassan Rouhani’s effort to normalise political and economic ties with the West. Nevertheless, the strategic value of the nuclear deal, and the need to reduce pressure on Iran’s stagnant economy, should compel the new administration to be pragmatic and make a bargain that enables the United States to re-enter the JCPOA. This step would see Washington remove the secondary sanctions imposed by Donald Trump, who thrust Iran’s economy into nearly three years of economic recession. In parallel, Iran would return to compliance with the controls placed on its nuclear programme by the JCPOA.

As negotiators in Vienna continue to push for a diplomatic breakthrough, officials across European capitals are examining how to revive EU-Iran trade following the lifting of US secondary sanctions. There are clear steps that governments can already take to encourage this trade and address European business leaders’ caution about resuming trade with Iran. But, unlike in the lead-up to the sanctions relief introduced in January 2016, the experience of the Trump administration’s “maximum pressure” campaign has made firms wary of both the durability of the nuclear deal and the reliability of sanctions relief. Companies now have a clearer understanding that sanctions relief does not mean that all barriers are lifted to doing business in Iran – banking challenges in particular will persist even if secondary sanctions are removed.

If the rebound in EU-Iran trade proves underwhelming, the renewed nuclear deal will be vulnerable. Tehran could, perhaps justifiably, cite failures in the implementation of economic commitments by the West. Indeed, senior Iranian officials, including the supreme leader, Ali Khamenei, have already warned that any sanctions relief must be “verified,” meaning that the benefits are clear in “in practice,” and not just “on paper.” And EU-Iran trade data suggest that such low-ebb scenarios may well be borne out.

Much will depend on whether Europeans resume buying Iranian oil.

The experience last time – starting in January 2016 – was of a significant recovery in EU-Iran trade. Looking to data compiled by Eurostat for the 24-month period following sanctions relief, monthly EU exports to Iran rose 47 per cent, while EU imports from Iran shot up 560 per cent, driven by the purchase of Iranian mineral oils, including crude oil. At the time, European companies were keenly aware of the opportunities presented by sanctions relief given the size of the Iranian market. They expected that securing the necessary legal and banking services to conduct business with Iran would be straightforward.

Since then, the maximum pressure campaign significantly degraded EU-Iran trade. The 24-month period up to April 2021 shows that monthly EU exports to Iran averaged just 63 per cent of the level seen in the two years until January 2016. Imports were just 61 per cent of the average in the same period. This time around, the rebound in EU-Iran trade could be bigger than in 2016 as the starting base is so much lower – but fewer companies are now interested in, or equipped to avail themselves of the opportunities presented by sanctions relief.

The previous 47 per cent and 560 per cent increases offer a baseline for understanding the impact of secondary sanctions relief if and when the US provides it. To account for both possibilities, one can consider pessimistic and optimistic scenarios in which the rise in EU-Iran trade would respectively be 80 per cent and 120 per cent of this baseline. Looking at these scenarios, it becomes clear that EU-Iran trade is unlikely to recover to the levels seen in the initial previous period of sanctions relief. In the pessimistic scenario, 24 months after the lifting of sanctions, monthly EU exports to Iran would average €457m. In the optimistic scenario this rises to €520m – a figure still significantly below the €648m average achieved in the initial period of JCPOA-related sanctions relief.

Imports suggest a similar story: 24 months on from the lifting of sanctions, monthly EU imports from Iran would average between €329m and €463m depending on the scenario that plays out – but this would still be significantly down on the EU imports average of €648m in the two years after the 2016 sanctions relief.

Much will depend on whether Europeans resume buying Iranian oil, as this would give Iran the financial means to purchase European goods. In the two years before January 2016, Iran ran a significant average monthly trade deficit of €128m, which partly reflected strong demand for European industrial goods following years of sanctions-related underinvestment. In the optimistic scenario outlined above, Iran’s trade deficit would narrow to €57m – a reduction that depends on a sharp increase in European oil imports. Without these, Iran has no major facilities to finance its trade with Europe. And this is just one of several potential structural barriers to growth in bilateral trade.

Restoring EU-Iran trade to the levels seen in the initial period of JCPOA-related sanctions relief will require both time and robust policy interventions. In the interim, trade with Iran will have less economic significance than the large size of Iran’s economy and the country’s proximity to Europe might suggest. Under the optimistic scenario, annual European exports to Iran would total around €6.2 billion while imports from Iran would total €5.6 billion – Iran would disappointingly rank somewhere between the Philippines and Pakistan among Europe’s trade partners. However, from a political and security standpoint, the European Union has no bilateral relationship in which a low volume of trade could prove so disproportionately important for fostering diplomatic relations and consolidating non-proliferation achievements.

It appears likely that Iran’s enormous economic potential will remain untapped by most European enterprises in the short term. Nevertheless, Europeans should ramp up their economic diplomacy. Those European companies that resume trading with Iran deserve the full support of their governments – the billions of euros of goods and services they trade will create the foundation for constructive EU-Iran relations. Without this foundation, pro-deal figures inside Iran, including in the new administration, will find it much harder to make the case for sustaining the agreement in the long term.

This article has been republished with permission from the European Council on Foreign Relations. The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of its individual authors.