Advocates of American “energy dominance” ought to have been humbled by the events of March 9.

On a single day, the price of oil fell an astonishing 30 percent. Since January, the West Texas Index has been halved, with prices falling from $60 to $30 per barrel.

The direct cause — a breakdown in the Saudi-Russian oil alliance and the declaration of a “price war,” with each promising to pump at full volume in order to flood the market — had little to do with the United States. But the first casualty of the 2020 oil price crash could be the American shale sector.

With prices this low, demand sagging and markets flooded with cheap crude, U.S. energy companies will be under immense pressure to cut spending, lay off workers, and scale back production.

The lesson in energy geopolitics is a stark one. Despite confident talk of American “energy independence,” this latest shock is further proof that the fossil fuel economy is global, entangled, and interdependent. Oil exports have made the United States more vulnerable to price shocks, rather than less.

Under the Bush administration, the energy conversation revolved around the imminent arrival of “peak oil” Built off the theories of geologist M. King Hubbert, who predicted the end of conventional oil production in the early 2000s, analysts and politicians predicted permanent high prices and general scarcity. An entire literature grew out of the era’s obsession with the coming oil apocalypse. And then shale arrived, and everything changed.

High prices between 2000 and 2008 spurred investment into hydraulic fracturing, a method for breaking apart oil deposits trapped in rock formations. The method, while fairly well-known in oil industry circles, had not been economic until persistent high prices and pressure to tap new deposits drove companies to invest during the Bush and Obama years.

The result was an increase in domestic U.S. oil and gas production, one that began in 2009 and rapidly accelerated, doubling output within 10 years from 5 million barrels per day (bpd) to 10 million bpd by 2018.

The Obama administration, despite outwardly advocating for clean energy and embracing the Paris Agreement on climate change, encouraged the growth of the domestic fossil fuel industry. In 2015, the administration backed a bill in Congress ending the crude export ban. The ban had originally been meant to conserve domestic energy resources. But the administration argued that dropping the ban would accelerate development and allow U.S. energy companies to compete internationally.

It should be noted that in December 2015, when the ban was lifted, oil prices had slumped to $36 a barrel. Saudi Arabia, wary of shale oil’s growth, was pumping at high levels in an attempt to drive American companies out of business. Dropping the export ban sent a fresh wave of investment into the sector. Shale hung on, and Riyadh abandoned its strategy in November 2016, opting instead for production cuts orchestrated with Russia and the rest of OPEC. Obama left office in 2017, having presided over the largest increase in domestic oil production in U.S. history.

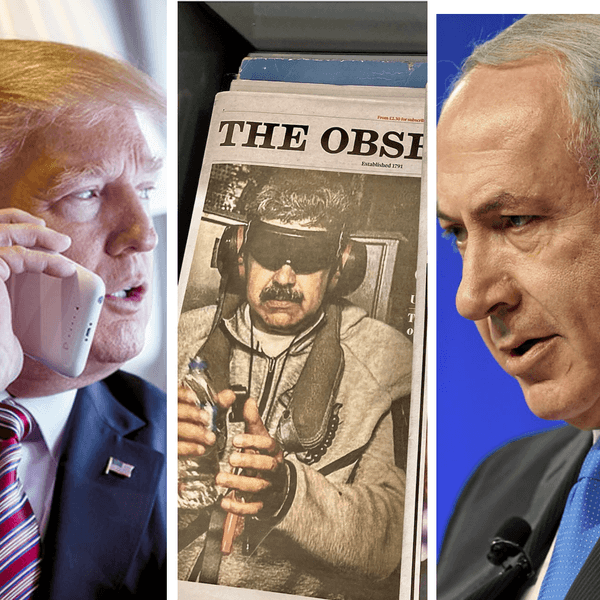

Donald Trump became president determined to undo the legacy of his predecessor. But his policies, unsurprisingly, have been very favorable to the U.S. energy industry. Regulations on methane emissions have been cut, more public lands are open for drilling, and Trump cultivated close ties to oil-men like Harold Hamm, whose Continental Resources opened up the Bakken Oil Field in Montana and North Dakota.

The Trump administration characterized its policy as “energy dominance.” Under President Trump, the United States would maximize its domestic energy production. While the push brought economic benefits, the administration also touted it as a national security strategy. “Instead of relying on foreign oil and foreign energy,” declared President Trump, “we are now relying on American energy and American workers like never before.”

And shale did seem to bring security. When supply shocks came, either through chaos in Venezuela, civil war in Libya, or new sanctions on Iran, the United States along with the price of oil appeared unaffected. The increase in U.S. output led pundits and analysts to question whether the Middle East was still important to American interests.

The president himself fed this idea. “With the tremendous progress we have made,” he stated in his 2020 State of the Union Address, “America is now energy independent.”

That, of course, is not true. Oil is a global commodity. Refineries in the United States require certain blends of foreign oil to remain in operation. The apparent resilience of the oil price to geopolitical shocks for the last several years is due to a persistent supply glut, one that has depressed prices and offered a cushion when output is interrupted from a particular source. When Iranian exports collapsed from 2 million bpd to less than 300,000 bpd between November 2018 and November 2019, for instance, it had little impact on prices.

Then came coronavirus. In February, China cut its demand forecast for the year. Fears of the virus prompted industry organizers to cancel CERAWeek, the industry’s largest gathering. Prior to their annual meeting in Vienna, Saudi Arabia began marshalling support for another deep production cut. But at the negotiating table, Russia refused to cooperate.

Perhaps Russia was sick of losing market share to shale. Or perhaps Vladimir Putin had finally grown tired of his fragile alliance with Saudi Arabia’s Crown Prince Mohammed bin Salman. In any event, each side left Vienna vowing to “pump at will.” They would flood the market with cheap crude, returning the global market to a state of true competition. The shock that came after the failed OPEC meeting sent oil prices and stock market indices crashing down.

The price war probably wasn’t about the United States — Russia and Saudi Arabia have bigger concerns, particularly the demand shock of the coronavirus and their own entangled relations. American oil companies are collateral damage. The collapse in price means that dozens of firms will be squeezed, perhaps to the breaking point, as investment slows and thousands of oil workers are laid-off amidst a general sectoral contraction.

It’s still too early to digest all the lessons from this price crash. Shale companies may prove more resilient than expected — they have survived similar shocks in the past.

At the very least, this shock should obliterate the myth of American “energy dominance,” a realization made all the more evident by the immediate talk of a shale bailout for American companies.

For as long as the U.S. remains glued to the fossil fuel economy, such blows must be endured. It is possible, however, that this latest development will encourage consumers, investors, and even the federal government to consider alternative sources of energy that are less vulnerable to such shocks.