President-elect Donald Trump likes to posture as a tough guy, and he’s not above veiled threats of military action against stated adversaries as a tool of influence. But at times he can be quite harsh in his rhetoric about the big weapons makers and their allies in the political sphere, too, as he was in a September speech in Milwaukee:

“I will expel the warmongers from our national security state and carry out a much needed clean up of the military industrial complex to stop the war profiteering and to always put America first. . . . We’re going to end these endless wars.”

Campaign statements rarely make it into actual policies untouched, and Trump’s critique of the military industrial complex is likely to be no exception. In his first term, from 2016 to 2020, Trump reversed course from his campaign statements about contractors ripping off the government to form a close bond with the arms industry once in office, especially when it came to taking credit for the jobs created by dubious policies like the arming of the Saudi regime during its brutal war in Yemen, continuing to tout overseas sales to countries like Saudi Arabia and their economic impacts at home even after the murder of U.S.-resident journalist Jamal Khashoggi.

Whether or not Trump goes after the warmongers and war profiteers in earnest, the fact that he called them out in public in such harsh terms was newsworthy in its own right — he was far more critical in tone and substance than any statement of any recent Democratic presidential candidate. At a minimum, it means that there is an appetite in Trump’s base for a less interventionist foreign policy and a firmer hand with military mega-firms like Lockheed Martin and RTX (formerly Raytheon).

The answer regarding which companies may benefit most from Pentagon spending in the new administration will likely be determined by rough and tumble politics, not well-informed debates over strategic priorities. And when it comes to exerting influence over Pentagon spending and policy, so far the military mega-firms like Lockheed Martin and RTX are being outmaneuvered by the emerging military technology firms clustered in and around Silicon Valley.

Trump confidante and government efficiency czar Elon Musk is best known to most Americans for the civilian undertakings of SpaceX and Tesla, but his empire is increasingly moving into military contracting, from launching military satellites to creating a military version of his Starlink communications system that has been used to supply reliable internet service to the Ukrainian military in its fight against Russia.

Going forward, the biggest cash cow for SpaceX may be the Starship system, which is designed to put huge payloads into space, a capacity that the U.S. military is seeking as it postures itself for a possible conflict with China. These interests could incline Musk to leave military tech projects alone, or even push to increase them, when his agency releases its proposals for remaking the federal budget.

In December, Musk drew praise from some Pentagon budget critics for his verbal assault on Lockheed Martin’s troubled F-35 combat aircraft, but he was careful to say that it would be replaced with greater reliance on the drones built by his Silicon Valley colleagues. The Silicon Valley argument for swapping out piloted aircraft for drones is couched in strategic and budgetary terms, including a claim that a force that relies on drones would be cheaper to build and maintain. But these claims of efficiency and cost effectiveness have yet to be proven, so shifting towards emerging technologies may or may not save money.

In addition to Musk, the military tech sector can rely on support from Vice President-elect J.D. Vance, who worked for five years at a firm owned by Peter Thiel, founder of the surveillance and military data crunching firm Palantir, before his successful 2022 run for the Senate, with millions in financial support from Thiel.

In addition, Trump’s choice for second-in-charge at the Pentagon — a position that is intimately involved in the day-to-day operations of the department — is Stephen Feinberg of Cerberus Capital, a firm with a long history of investing in arms companies, including emerging tech firms, as it did early last year when it bought hypersonic and defense test systems businesses from TransDigm Group.

What do the tech executives want? More Pentagon contracts, less regulation in the purchase of new systems, and a foreign policy that relies on technological superiority to restore U.S. global military dominance. In some respects these demands overlap with the interests of Lockheed Martin and the other big contractors, but the Pentagon may have a hard time funding legacy systems like F-35s, aircraft carriers, and intercontinental ballistic missiles along with ambitious new projects based on emerging technologies. So there could be a budget brawl between the incumbent contractors and the Silicon Valley upstarts, with the winner determining the shape of U.S. weapons procurement choices for years to come.

Meanwhile, Lockheed Martin Chief Financial Officer Jay Malave has expressed his hope that for the Pentagon, efficiency could be consistent with increasing the department’s budget:

“With government efficiency, you could see elements of addition by subtraction, so ultimately, you could see a higher budget request than what we've seen from the prior administration, but it could be as a result of some things either being curtailed or canceled, and other things being prioritized.”

If Malave is right, and the Pentagon gets another big funding boost under cover of a campaign for “efficiency,” both sides of the old guard versus new tech fight within the arms sector could end up doing just fine — at our expense, and the expense of other needed programs for which “efficiency” may mean deep cuts.

Congress and the public need to keep a close eye on both wings of the military industrial complex under the new administration, demanding that decisions about what weapons to purchase and what strategy to pursue be made through carefully considered deliberations conducted in the public eye, not the needs of politically-wired companies that want to feed on the Pentagon budget to pad their bottom lines well into the future.

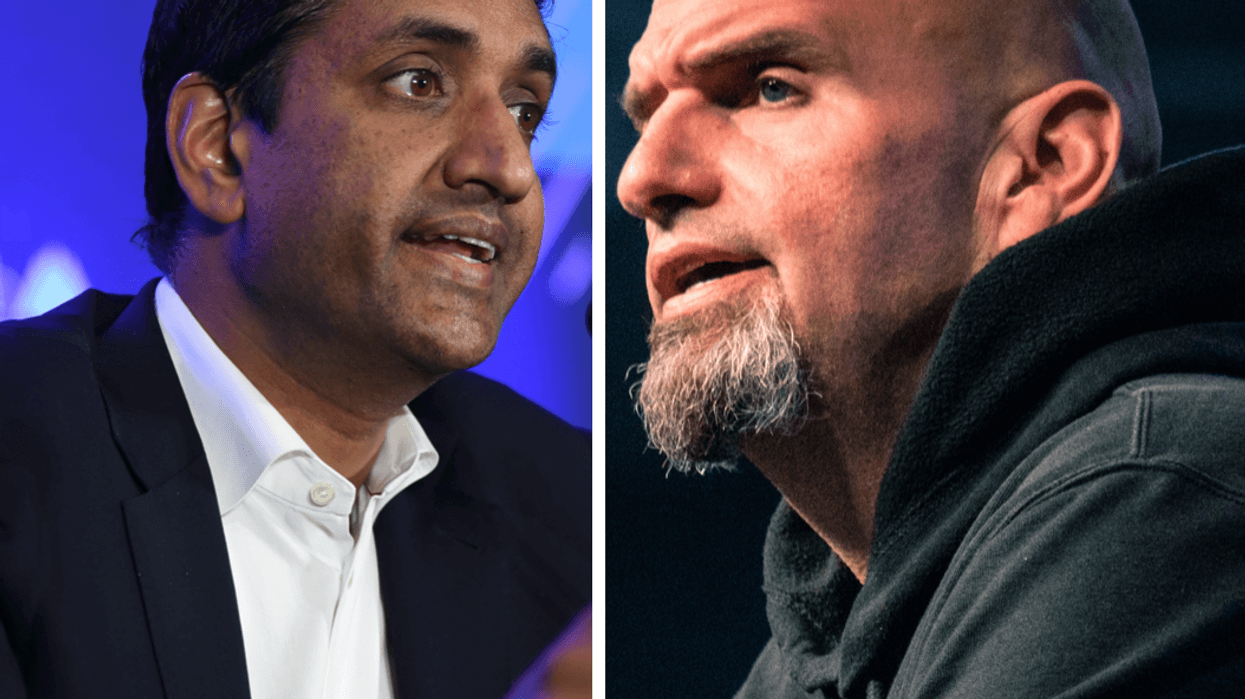

- Thiel pal and venture capitalist eyed for 2nd highest post in Pentagon ›

- The low hanging DOGE fruit at the Pentagon for Elon and Vivek ›

- 'America First' meets Greenland, Taiwan, and the Panama Canal | Responsible Statecraft ›

- Did Trump just crown Saudi with leadership of Gaza ‘day after’ plan? | Responsible Statecraft ›