Iran’s request for a $5 billion emergency loan from the International Monetary Fund (IMF) is revealing serious desperation, and not only on the part of the Iranian government. Desperation is also apparent in the responses from the Trump administration and the regime change lobby in Washington led by the Foundation for the Defense of Democracies (FDD) as they try to block the loan.

In a few short weeks, their message has gone from one extreme to another: from repeating that Iran’s economy is near collapse, to saying that the country is flush with money. But they cannot have it both ways. With the economy not showing any sign of imminent collapse and Iran’s leaders still defiant, the first message was clearly a misreading of the facts. The new message misleads with bad data.

President Hassan Rouhani’s government has a good excuse for taking the difficult step of requesting an IMF loan in defiance of Iran’s conservative opposition. It is struggling on three fronts — sanctions, the coronavirus, and the collapse of oil prices.

The budget for 2020/21, approved one month ago, assumed oil revenues of about $10 billion, but with oil prices currently half of what they were in early March, $5 billion is more likely. Hence the justification for Iran’s first request for an IMF loan in 60 years.

Indeed, the case for maintaining and tightening sanctions while the epidemic ravages Iran lacks strategic and moral ground.

Calls from world leaders, former U.S. diplomats, and the United Nations have appealed to Trump to ease sanctions. In response, the Trump administration and its supporters have switched from the wait-for-collapse argument to saying that Iran does not need the money, disingenuously quoting President Rouhani as he boasts about how well his government is dealing with the pandemic.

The State Department has denounced Iran’s IMF request as a scam, intended not to fill a glaring budget gap but to get its hands on hard currency to pay its regional proxies.

The specious argument that Iran does not need help relies on very misleading data. In 2013, Reuters investigated the assets of the sprawling conglomerate under Ayatollah Khamenei’s control known as Setad (Setâd-e Ejrây-ye Farmân-e Emâm, or Executive Headquarters of Imam's Directive). Setad was established in 1981 to manage the properties confiscated by the revolutionary government, about 60 percent of which is in real estate and the rest in corporate holdings. (The U.S. State Department referred to it as a “hedge fund” by mistake.)

Reuters estimated the value of Setad’s assets in 2013 at $95 billion. This number seriously over-values these assets because it divides their value in rials (Iran’s currency) by the official exchange rate of 12,260 rials per USD, which is one-third the free market exchange rate (36,976 rials per USD).

It has long been the practice of western media to prefer the free market rate over the official exchange rate when they want to emphasize the poor quality of welfare in Iran, such as the minimum wage. One can only speculate why Reuters chose the official exchange rate for this purpose. But it seems reasonable to use the free market exchange rate to estimate the buying power of Setad’s assets abroad at that time, in which case $31.5 billion is a more realistic number.

The Supreme Leader also controls several other foundations, the most important of which is Bonyad Mostazafan (or “the Foundation for the Disinherited”) with an estimated worth of 630 trillion rials (or $7 billion) in 2017, followed by Astan-e Ghods Razavi, which manages properties held in the name of the eighth holy Imam in Mashhad (Eghtesadonline, link in Persian).

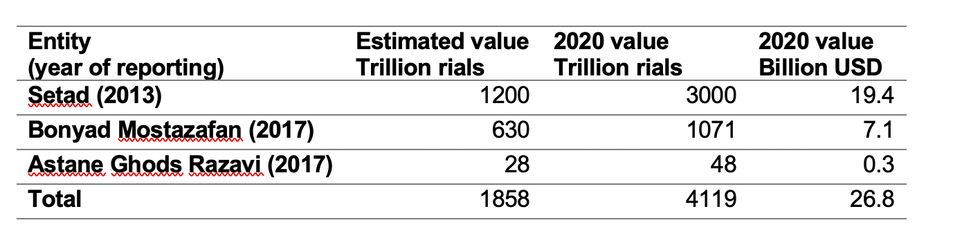

The table below compares the current value of the assets held by the holding companies under the Supreme Leader’s control. These estimates are to be taken with a large grain of salt as the studies on which they are based are not published or vetted by independent sources. But they are useful to get an idea of the orders of magnitude.

According to these estimates, the total value of assets under the Supreme Leader’s control in 2020 (valued at the free market exchange rate) is less than $27 billion, much lower than the $95 billion reported by Reuters in 2013, and later repeated by Secretary of State Mike Pompeo. It is also a far cry from the $200 billion estimate promulgated by FDD in 2018, which it inflated to $300 billion in 2020 without explanation. Throughout the past nearly two decades, FDD has led the push for regime change in Iran.

The value of assets held by entities under the control of Iran’s Supreme Leader:

(Notes: The years of the estimates in parenthesis; inflation adjustment for 2020 values is 2.5 for 2013 and 1.7 for 2017 rial values. The exchange rate used to convert the rial values into dollars is 155,000 rials per USD, the average for the last two weeks. Source: Reuters and Eghtesadonline.com. )

The argument that Iran is flush with cash and can buy all the medical supplies it needs to fight the epidemic ignores a very basic issue that both Setad and the Bonyad Mostazafan are on the sanctions list. Even if they decided to sell their assets and buy foreign currency, would a foreign bank be willing to accept their money knowing that they are on the sanctions list? Would a supplier risk sending medical equipment to Iran that might end up in hospital owned by Iran’s Revolutionary Guards, which have been designated by the U.S. as a terrorist organization? Of course not, and of all people, those who have sold efficacy of sanctions to the American people and Iranian dissidents should know this.

Finally, this argument undermines the justification for the maximum pressure campaign.

If after two years of maximum pressure Iran is flush with cash, was the policy oversold? In 2017, before becoming the Trump’s national security adviser, John Bolton received a standing ovation when he assured his audience of Iranian “opposition” groups that, "before 2019 we here will celebrate in Tehran!” If Khamenei really has so much wealth at his disposal as proponents of regime change suggest, then Bolton’s promise to squeeze Iran “until the pips squeak,” is a long way off.

The Trump administration left the Iran nuclear deal two years ago with the ostensible purpose of squeezing more concessions from Iran. In this it has surely failed. The supporters of regime change now find themselves in the strange position of saying in the same breath that COVID-19 may be the proverbial straw that breaks the camel’s back on the one hand, and on the other that Iran has plenty of money left to provide for its people while defying the US – a sign that they have stuck to the failed policy of maximum pressure for too long.