Ties between big finance and the weapons industry are not new. The first venture capital firm in the U.S. was founded to profit from new technologies developed for use in WWII, and the role of military spending in turning Silicon Valley into a tech hub is well documented.

But today’s biggest VC titans are making transformative investments in military technology that pose serious consequences far beyond another hype-driven tech bubble. Weaponizing their financial assets to expand the production of war material will not only divert technological resources away from other critical domestic priorities, but also forge novel devices of warfare that will generate demand for battlefield testing grounds both at home and abroad.

But before the defense tech evangelists can resurrect the age of American global supremacy, they must transform the way the Pentagon does business. This involves seducing Pentagon planners with exotic promises ranging from “attritable autonomous systems” (or swarm) technology to subscription models for weapons systems — not because these fit some strategic framework but because they align with the VC business model.

Venture capital and private equity is about making limited investments in mobile assets (technologies, engineers) to get a startup to the IPO stage (or trim the fat from an existing operator) and cash out. This is at odds with a military industrial complex that boasts millions of employees and a handful of oligopolistic firms with billions of dollars of permanent infrastructure, huge up-front costs, long time horizons, and extremely complex procurement processes.

The fingerprints of VC priorities are everywhere: from the Pentagon’s Office of Strategic Capital and the Small Business Investment Company/SBIC initiative to the Defense Innovation Board, a collection of Silicon Valley scions elevated to a permanent department under the Secretary of Defense in October 2023.

Typically, the Pentagon acquires technologies or equipment through private contracts with a company or by supplying grants to provide funds for research and development. The new Office of Strategic Capital, established in December 2022, lets the Pentagon behave less like a public agency and more like a VC investor.

It was in this new spirit that Silicon Valley investors in March 2023 lobbied the Pentagon to bail out Silicon Valley Bank (where many of them had hundreds of millions deposited) by claiming that they would be damaged (thereby losing the Pentagon critical capabilities) if they weren’t rescued. Deploying the argument that a run on SVB would be a "national security risk," the Pentagon and its supporters advocated for federal government intervention, according to The Intercept, and the Treasury Department ultimately interceded to bail out SVB on March 12, protecting investors.*

The financial services sector is likewise providing innovative products to facilitate the expansion of VC-backed defense tech in Pentagon contracting. One example is Leonid Bank, which is an invoice factoring company that basically lends to defense tech startups based on the DOD invoices that those startups have for future projects, to provide them with more money (over and above the contract value) which is not something that has ever existed for Pentagon contracts.

Much of the VC discourse emphasizes the benefits of reforming the procurement system to acquire more “commercial” off-the-shelf items not custom built just for the Pentagon. This transformation is marketed as a way of matching the production methods of global adversaries, because development is faster and cheaper; if there are venture investors and other funds involved then the government is footing less of the upfront bill.

However, if the success of the product and the firm that develops it is dependent on the widespread adoption of that technology commercially this will introduce a new range of militarized technologies into a global system that is already awash with lethal tech, dystopian surveillance products, and an ideology that depicts weapons production as the primary avenue to innovation, economic growth, decent industrial jobs, and infrastructure spending.

The stated desire of venture capital (and the increasing number of private equity funds focused on military tech) is to disrupt an industry they see as monopolistic, inefficient, and too close to government bureaucracy. This rationale is easy to understand, as the path to innovation for the prime contractors has for decades been external: find small firms developing marginally improved technologies or hardware parts, acquire them and integrate their products into existing large weapons platforms.

The financial industry – VC firms, asset managers, PE fund managers – have observed (correctly) that if they can find the small tech firms first (or fund them into existence) then the potential profits are enormous.

VCs also identify startups working on civilian technologies and steer them toward developing military applications. Startups working on technologies to improve navigation in driverless vehicles may find that after a new round of investment their objective is to apply those technologies to weapons targeting systems.

Individual engineers working on civilian tech are also being lured away by the promise of better funding and broader impact from defense investors. If startups want to see their technologies advance they’re much more likely to find the necessary funding if they pivot to military applications.

Venture capitalists are eagerly supplying geostrategic justifications and policy blueprints to the Pentagon on how to reshape its contracting ecosystem to facilitate this shift. An example from one of the most well-known VC funds, Andreesen Horowitz, focuses on the promise of “attritable” warfare – specifically a model of warfare that uses technology to develop cheaper, simpler weapons in large quantities.

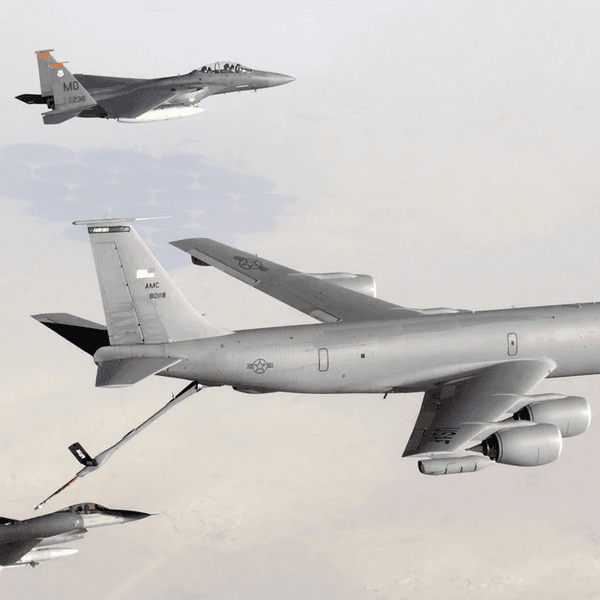

One example of this style of warfare is the Pentagon’s “Replicator” initiative to develop drone swarm capabilities — basically the capacity to field literally thousands (maybe tens of thousands) of drones simultaneously. And this is “attritable” because each individual drone unit is cheap and simple to deploy, so that the moment it’s knocked out of the sky it’s already been replaced by two more.

But this requires an enormous amount of coding, and constant re-coding and re-writing which is not necessarily a capability that exists in the big primes. Predictably, the response from major think tanks (whose primary funders are the primes) is that these kinds of initiatives are “crowding out” the focus on “long-range precision fire programs” — which is code for the huge range of super expensive fighter jets and missile systems that are the bread and butter of firms like Lockheed and Northrop Grumman.

So VC firms like Andreesen Horowitz kindly offer guidance for this transition: “As general computing platforms become applicable to a host of defense applications, from programming autonomous behavior to conducting live targeting analysis, sweeping advances in software and other technologies not originally designed for defense have unintentionally compounded computing’s impact on war…..Responding to the paradigm shift requires reengineering the Pentagon’s DNA for a new era.” [author’s italics]

The AH authors emphasize that this reengineering will allow for a “reduction in operational complexity, driving lower costs through commoditization” with “smaller” “modular modern production” that uses “‘just-in-time’ manufacturing techniques like 3D printing to cut latency” allowing for “decentralizing a military’s industrial footprint.”

This reads a lot like outsourcing the military industrial supply chain, which may sound revolutionary. But the huge weapons platforms in use by the U.S. military already incorporate parts and materials from all over the world, including a lot of stuff from China. So this modification is more about transforming production so VC-backed firms have an entry point into production chains currently dominated by the primes.

To achieve this, Andreesen Horowitz advocates what they call “Broad and open API standards” that would presumably enable startups to propose the use of cheaper/more widely-available materials and technology for incorporation into the expensive platforms built by the primes. This would mean that some material the primes consider proprietary would have to be opened up to tinkering.

Not to be outdone, the primes are putting their own pressure on the Pentagon to counter the challenge from VC-backed startups. Their latest efforts focus on speeding up and expanding the scope for foreign military sales by allowing overseas customers to purchase research and development services to design new weapons. And they’re pushing for other modifications that would turbocharge technology transfer and joint ventures to help lock-in future exports.

In the battle between the primes and the VC-backed tech firms to expand the U.S. arsenal, the Pentagon is ill-equipped to responsibly navigate the competing interests, least of all since its senior members are routinely bought off with (entirely legal) sinecures. It’s a battle with a sadly predictable outcome, because no matter which side wins, we all will pay the cost.

Editor's Note: The story has been edited to accurately reflect the timeline of when and how defense tech investors lobbied the Pentagon for SVB bailout in March 2023.

- Do venture capitalists want forever war? ›

- VC/DC: Silicon Valley wants its cut of US military spending | Responsible Statecraft ›

- Killer AI is a patriotic duty? Silicon Valley comes to Washington | Responsible Statecraft ›

- Who gives 'Three Cheers for the Military-Industrial Complex'? | Responsible Statecraft ›

- Thiel pal and venture capitalist eyed for 2nd highest post in Pentagon | Responsible Statecraft ›

- Defense startup announces world’s ‘first autonomous fighter jet’ | Responsible Statecraft ›

- Military contractors reap big profits in war-to-homeland pipeline | Responsible Statecraft ›