After six years of U.S. “maximum pressure,” Iran’s economy continues to defy dire predictions of economic collapse that motivated Trump’s hasty 2018 withdrawal from the Iran nuclear deal (also known as the JCPOA). The Biden administration’s continuation of the same policy since 2021 is similarly based on the logic that the weaker Iran’s economy is, the more likely Tehran will bend to Washington’s will.

The economy’s resilience is evidenced by the fact that in the first nine months of the Iranian fiscal year (March 21 to December 20, 2023), GDP grew by a 6.7% annual rate, and it is very likely to finish the year in two months with a growth rate exceeding the World Bank and IMF forecasts of about 4%.

But, after more than a decade of decline in their living standards, resilience is not what ordinary Iranians are looking for. As a result of Trump’s reimposition of sanctions in 2018, Iran’s economic growth fell by 13.6 percentage points, from a positive annual growth rate of 9.5% during 2016-2017, when the JCPOA had eased U.S. sanctions, to negative 4.1% per year during 2018-2019.

Since 2020, and helped by rising oil revenues, the economy has recovered some, growing steadily, if slowly, by about 4% per year. Even the damage from the Covid-19 pandemic, which was mostly on employment, has been repaired, and employment is now back to its pre-pandemic level. But, as Israel’s war on Gaza continues, renewed tensions and proxy fights with the U.S. could put these fragile gains at risk of a reversal.

Flawed recovery

This modest growth has done little to dampen deep dissatisfaction with the economy among ordinary Iranians. Living standards have not yet recovered to their pre-Trump level, and inflation remains very high. In 2022, real household expenditures per capita were 7.7% below their 2017 level, far below where Iranians expected to be now based on two decades of rising real consumption before sanctions tightened in 2011.

Inflation is an even larger source of popular discontent. For reasons that are not peculiar to Iranian society, people show more concern with rising prices than real incomes. They are unhappy with rising prices even if their incomes are keeping up with inflation.

In 2018, with poor prospects from oil exports, the rial lost 2/3 of its value in a short time and caused prices to spike. Inflation rose from 8.1% in 2017 to 26.7% in 2018 and has remained above 30% since. Since the beginning of the Iranian year, a new Central Bank governor has tried to reduce inflation to below 30%, a very modest goal, but so far he has not succeeded. Last month, inflation was at 36.5% annual rate despite tightened credit and fiscal austerity, which shows itself in a stagnant real estate market.

This mixed record is what hardliners are presenting to voters in the March 1 parliamentary elections and the record that President Ebrahim Raisi will be defending when he stands for re-election in June 2025. And this is no ordinary re-election because hardliners, who view the Raisi administration as the first “revolutionary government” since the founding of the Islamic Republic, hope to deliver on their promise of economic prosperity. They need to convince voters that their strategy of giving up on the nuclear deal and turning to the East (read China and Russia) can do better than the record of reformist presidents Mohammad Khatami (1997-2005) and Hassan Rouhani (2013-2021), whom they consider pro-west and “neo-liberal”.

Both Khatami and Rouhani were re-elected with bigger margins to their second terms. For President Raisi to do the same in 2025 he needs the robust growth rate of the past year to continue in 2024. As I argued last November, meeting this challenge is an important reason why Iranian hardliners are unwilling to get drawn into the Israel-Hamas conflict.

Darker clouds on the horizon threaten economic recovery

Besides the fact that economies grow faster when they are recovering from a trough, the growth should slow down in 2024. In addition, rising tensions in the region worsen the prospect for growth. Iran may be intent on not getting involved, but protecting its fragile recovery from an expanding regional conflict may be increasingly difficult. Iran’s allies in the “resistance front” in Yemen, Iraq, Syria, and Lebanon are challenging U.S. and Israeli forces. Even if Iran stays out of the fray, the conflict is bound to have a negative effect on Iran’s recovery, if only because Washington would try harder to limit Iran’s oil exports and refuse Iran access to its previously frozen funds.

This month Iran angered Iraq and Pakistan after it bombed two locations in these countries, ostensibly taking revenge for a terrorist attack a month ago in Kerman that killed over 100 bystanders. Adding a third nuclear power to the two that it is already in conflict with – the U.S. and Israel – may show Iran’s military resolve but also increases the risk of conflict.

Rising tensions have caused the rial, which enjoyed months of stability, to lose 10% of its value in the free market just in the past two weeks. If the rial continues to lose value, the task of bringing inflation down to below 30% will become much harder in the coming months.

More lax enforcement of oil sanctions since Biden’s election, intended to keep Iran from increasing its stockpile of enriched uranium and obtain the release of U.S. hostages, has allowed Tehran to sell more oil. More oil revenues have been the largest factor in Iran’s economic recovery. According to the Statistical Center of Iran, in the last three years the value added of the oil and gas sector has grown three times as fast as the GDP. So, if Washington decides to police Iran’ oil exports more aggressively, growth will suffer.

Finally, in the longer run, the financial components of U.S. sanctions prevent Iran from taking advantage of its deep devaluations by increasing its non-oil exports. Devaluations have reduced the cost of unskilled Iranian labor in export markets to about $10 per day, half the average unskilled wage in China. Devaluations helped Iran substitute its own products for imports, but there are limits to this substitution, especially with the domestic demand depressed to fight inflation. A fuller economic recovery from the loss of oil exports requires exporting more manufactures and services, which financial sanctions make costly and difficult.

Escaping sanctions?

Iran’s recent diplomatic successes have reduced its isolation but will not translate into economic growth in the short term. In 2023, Iran, aided by China, repaired its broken diplomatic relations with its Persian Gulf neighbors; gained entry into BRICS, an organization that includes rising non-aligned global players; and joined the Shanghai Cooperation Organization that, at least in one observer’s opinion, is a “game changer.” While these developments bode well for Iran’s ability to resist U.S. sanctions in the long run, they are unlikely to translate into more investment and economic growth in the short run.

What these successes have accomplished so far is to convince Iranian hardliners that their strategy of resistance to U.S. pressure has raised the Islamic Republic’s global stature, just as the West has tried to isolate it. They see the emerging multipolar world as one in which unilateral sanctions lose their sting and one that allows Iran to turn its newfound geopolitical capital into economic growth.

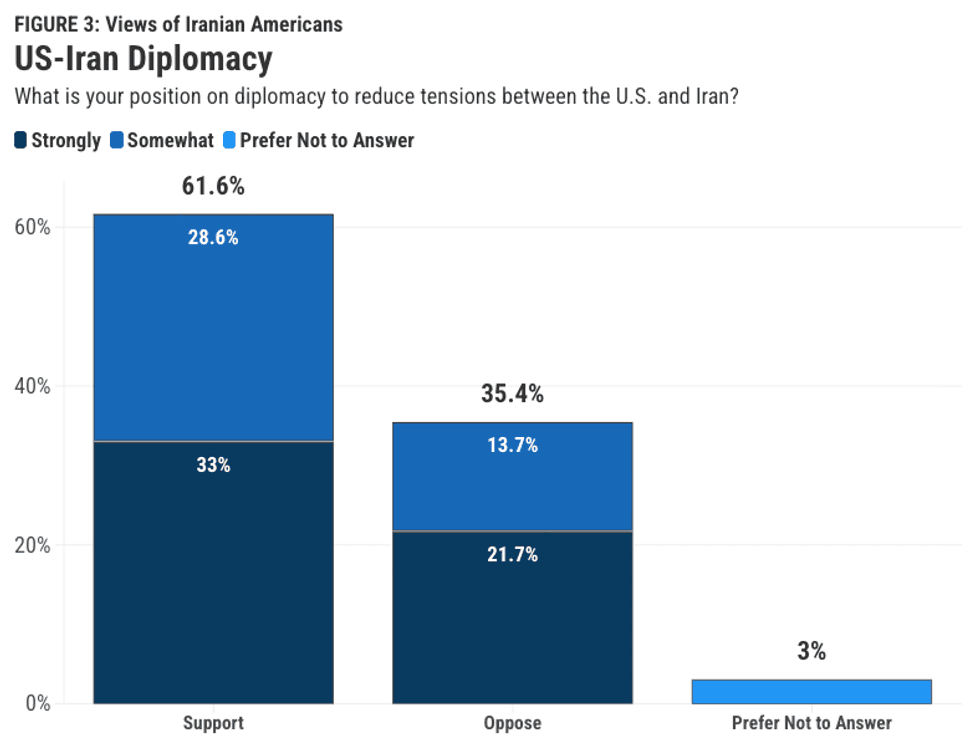

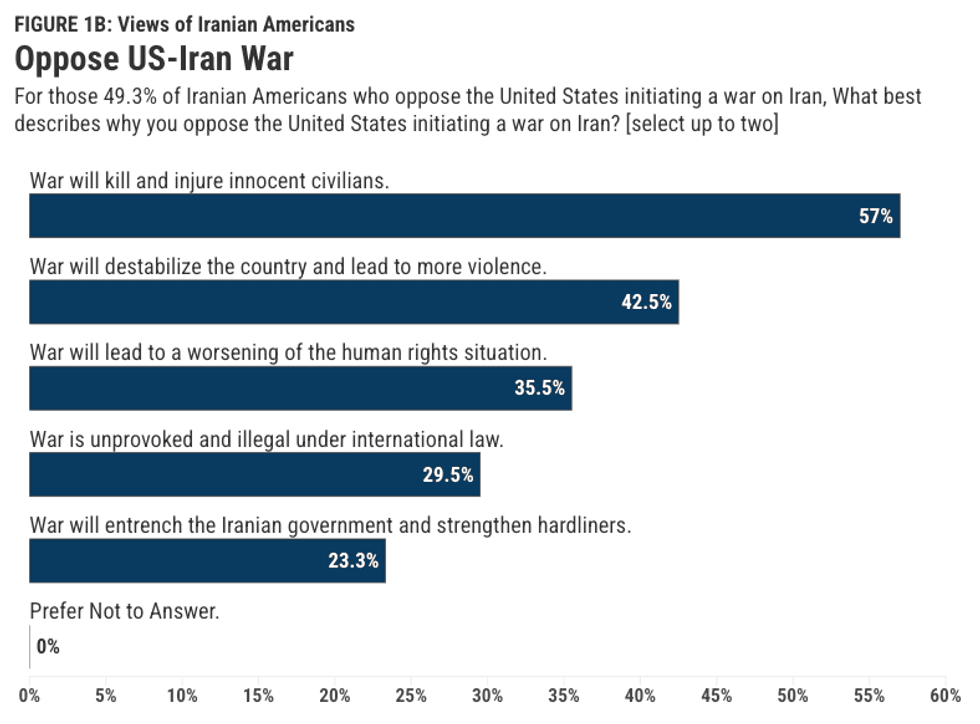

Screengrab via niacouncil.org

Screengrab via niacouncil.org Screengrab via niacouncil.org

Screengrab via niacouncil.org