Leading military contractors jacked up the price of several everyday products after receiving non-competitive contracts, costing taxpayers more than $1.3 million in apparently unnecessary markups, according to Pentagon contracting data acquired by Responsible Statecraft.

Until 2010, Boeing charged an average of $300 for a trash container used in the E-3 Sentry, a surveillance and radar plane based on the 707 civilian airliner. When the 707 fell out of use in the United States, the trash can was no longer a “commercial” item, meaning that Boeing was not obligated to keep its price at previous levels, according to a weapons industry source who spoke to RS.

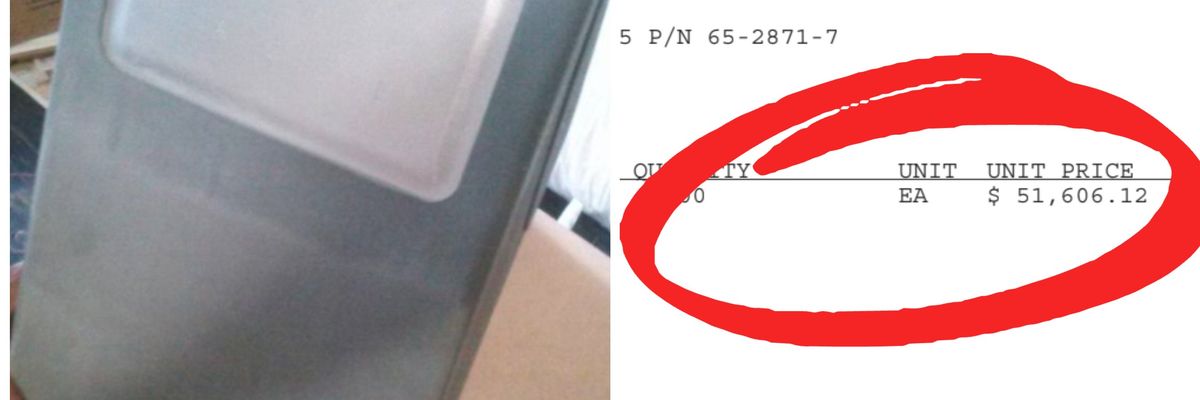

In 2020, the Pentagon paid Boeing over $200,000 for four of the trash cans, translating to roughly $51,606 per unit. In a 2021 contract, the company charged $36,640 each for 11 trash containers, resulting in a total cost of more than $400,000. The apparent overcharge cost taxpayers an extra $600,000 between the two contracts.

In another case, Lockheed Martin hiked the price of an electrical conduit for the P-3 plane as much as 14 fold, costing the Pentagon an additional $133,000 between 2008 and 2015.

Jamaica Bearings — a company that distributes parts manufactured by other firms — sold the Department of Defense 13 radio filters that had once cost $350 each for nearly $49,000 per unit in 2022. The apparent markup cost taxpayers more than $600,000 in extra fees.

The examples revealed here represent only a small portion of what experts say is a pattern of contractors overcharging DoD for a wide range of parts and weapons systems, a practice that reduces military readiness and drives up spending. A recent investigation by 60 Minutes highlighted rampant price gouging in the arms industry, including one case in which Boeing overcharged taxpayers by more than half a billion dollars for missiles used in the Patriot missile defense system.

The investigation also revealed that Raytheon Technologies had raised the price of Stinger missiles from $25,000 to more than $400,000 per unit. “Even accounting for inflation and some improvements, that's a seven-fold increase,” Shay Assad, a former Pentagon acquisitions official, told 60 Minutes.

In a letter sparked by the investigation, a bipartisan group of senators called on the Pentagon to investigate allegations of widespread price gouging by contractors.

“These companies have abused the trust [the] government has placed in them, exploiting their position as sole suppliers for certain items to increase prices far above inflation or any reasonable profit margin,” wrote Sens. Bernie Sanders (D-Vt.), Elizabeth Warren (D-Mass.), Ron Wyden (D-Ore.), Chuck Grassley (R-Iowa), and Mike Braun (R-Ind.).

“The DOD can no longer expect Congress or the American taxpayer to underwrite record military spending while simultaneously failing to account for the hundreds of billions it hands out every year to spectacularly profitable private corporations,” they added.

Boeing declined to comment on its alleged price gouging. Jamaica Bearings did not respond to questions about the price hikes or how much it paid to procure the radio filters before selling them to the Pentagon.

Lockheed Martin did not respond to a request for comment from RS, but it told 60 Minutes that it negotiates with the Pentagon “in good faith” and said its sales to the government are “in compliance with Federal Acquisition Regulations and all other applicable laws.”

The revelations come as major arms manufacturers boast record revenues. Lockheed Martin, General Dynamics, and Raytheon Technologies have each reported all-time highs in demand following Russia’s invasion of Ukraine, allowing the companies to give shareholders nearly $20 billion last year through stock buybacks and dividends. And the CEOs of the top five weapons makers each make between $18 million and $23 million per year.

About half of the Biden administration’s $842 billion Pentagon budget request goes to contractors. In 2022, roughly 30 percent of military spending went to the “big five” weapons makers, which include Raytheon, Boeing, Lockheed Martin, General Dynamics, and Northrop Grumman.

Experts say much of that contractor price gouging has worsened over the past few decades as the military sector has experienced dramatic consolidation. In the 1990s, there were more than 50 “prime” DoD contractors capable of competing for major contracts. Now, there are only five.

In practice, this means that many contracts receive only one bid, leaving little reason for companies to offer a fair price. Opportunities for gouging are particularly widespread when it comes to smaller contracts since contractors are not required to share their costs for any deals valued at less than $2 million, as the Intercept noted last year.

As the Government Accountability Office recently reported, nearly 20,000 small businesses have bowed out of military contracting in the past decade, creating further opportunities for price hikes.