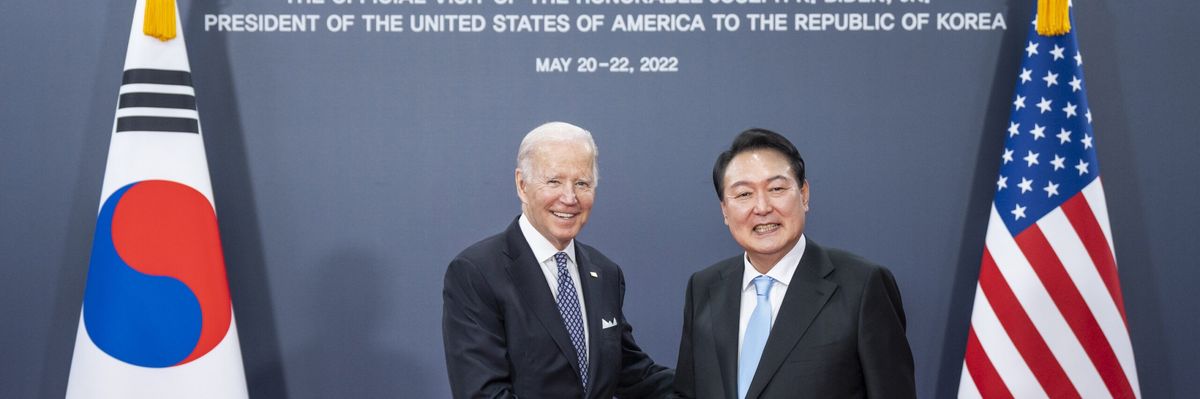

South Korean President Yoon Suk-yeol and President Joe Biden hope to celebrate the 70th anniversary of the U.S.-South Korea alliance as the two leaders meet in Washington on Wednesday. The much anticipated summit will seek to strengthen bilateral cooperation in various issue areas, including deterrence against North Korean nuclear threats, trade and supply chains, cyberspace, socio-cultural exchanges, and more.

Nevertheless, while aligned on many issues, Washington and Seoul also have conflicts of interest to manage. Particularly important to South Koreans right now is whether Yoon can convince Biden to minimize penalties that come with South Korean semiconductor investments in the United States, especially related to U.S. export restrictions designed to keep South Korean companies from doing business in China.

The semiconductor issue has been widely covered by the South Korean media approaching the summit — indeed, South Korea has much to worry about regarding chip technology cooperation with the United States. While the U.S. market offers attractive business opportunities for South Korean companies, it also carries considerable risks for South Korea.

One such risk is the requirement for investing companies to share confidential corporate information with the U.S. government in order to receive subsidies and tax credits, referred to as a “poison pill” in South Korea. The general concern is that the data-sharing clause can be taken advantage of eventually and come at the cost of South Korea’s own technological competitiveness and innovation.

At the end of the day, the United States and South Korea are rivals before partners in the semiconductor domain. South Korea wanting more assurances to protect its operational secrets only seems fair.

However, the bigger South Korean dilemma arises from American attempts to control South Korean business activities outside the United States rather than inside. In order to receive investment funds from the U.S. government, companies must comply with export restrictions that would seriously prevent them from investing and producing chips in China. These “anti-China decoupling” measures have alarmed Seoul as they can severely disrupt South Korea’s semiconductor industry.

South Korean companies, notably Samsung and SK Hynix, have invested billions of dollars over the years to build factories in China, where much of their chip manufacturing takes place now. And these factories require continued expansion and upgrades to produce more advanced, next-generation chips in the future.

But with the U.S. investment prohibitions, Samsung and SK Hynix would find no other option but to spend a lot more money to build factories elsewhere and eventually shut down their outdated China factories. This zero-sum notion of choosing American or Chinese markets has met whole-of-society resistance from the South Korean business community, government, parliament, and public.

South Korean business leaders, including Samsung and SK Hynix chiefs, have voiced their determination to keep doing business in China and have closely consulted the government to explore solutions. Over the past months, South Korean ministers, security advisors, and even President Yoon himself have held dozens of combined meetings with U.S. officials in pursuit of greater assurances regarding investment requirements related to China.

The sharply divided National Assembly has also been united for a rare occasion on this particular matter, criticizing American unilateralism and urging appropriate policy adjustments.

A sense of reservation about anti-China decoupling remains strong among South Korean citizens as well, despite their soaring unfavorability of China. According to a 2022 East Asia Institute-Hankook Research survey, only 7 percent of South Koreans support decoupling from China; the rest want to maintain a sensible working relationship with China based on economic and strategic cooperation.

The survey also shockingly revealed that South Koreans see bigger dangers coming from the U.S.-China tech competition than even the North Korean nuclear threat. Resonating with these sentiments is a recent Gallup poll finding that 83 percent of South Koreans have problems with the U.S. semiconductor policy.

The stunningly high South Korean threat perception of geoeconomic polarization makes sense in light of prolonged trade deficits over the past year primarily caused by reduced semiconductor sales, especially via China. South Korea’s economy will struggle when its semiconductor industry, the biggest source of national income, struggles. And a crucial part of this economic structure is China — the largest consumer and supplier of the South Korean chip industry.

Now that China has started reopening from pandemic lockdowns, South Korea hopes to bring chip trade volume with China back up and create momentum for recovery from its ongoing severe economic downturn.

It remains to be seen if Biden intends to loosen investment restrictions to the degree that Yoon wants. Given his sharp focus on confronting authoritarian enemies, mainly China, and considering that choking China’s chip supply is a key objective in Biden’s China containment strategy, he might not have much willingness to accommodate Yoon.

That said, Biden will be scoring an own goal by neglecting South Korean concerns about the semiconductor issue at Wednesday’s summit. Such can backfire in many ways, triggering widespread resentment in South Korea against U.S. backstabbing, causing more tension and friction within the alliance, and dissuading future South Korean investments in the United States.

Many South Koreans expect Biden’s accommodation on the chip issue as a concession in return for a big favor that Yoon has done for him recently — improving South Korea-Japan ties and filling the perceived weak link in the South Korea-U.S.-Japan trilateral partnership that Washington has been eager to strengthen.

Despite fierce domestic opposition, Yoon made a very unpopular decision a few weeks ago to exempt Tokyo from compensating Korean victims who were subject to Imperial Japan’s forced labor conscription. Yoon’s approval rating has plummeted since, with foreign policy being cited as the primary reason for disapproval. Yoon has pushed through domestic pressure for the sake of improving the trilateral ties with Washington and Tokyo. Yoon has done a big favor for Biden, and it is Biden’s turn to return the favor.

Without appropriate gestures by Washington, tension and friction within the alliance could grow in light of mounting frustration in South Korea over U.S. protectionist and discriminatory policies.

More importantly, overly stringent and anti-China U.S. investment restrictions can eventually dissuade South Korea from investing more assertively in the U.S. market. The United States ultimately needs South Korean investments and production capabilities to reshore and advance its semiconductor industry. The focus then should be on how to attract South Korean companies, not how to isolate China.