On Tuesday, President Biden announced that the United States will ban the import of Russian fossil fuels. The decision preempts possible legislative action by Congress to do the same. Although only about 8 percent of U.S. fossil fuel imports come from Russia, the decision has driven fuel costs even higher. The national average price for a gallon of regular gasoline in the U.S. reached $4.17, a new record, based on anticipation of Biden’s announcement, surpassing spikes witnessed in summer 2008 prior to the financial crisis.

Rumors circulated that Biden may travel to Saudi Arabia to ask Crown Prince Mohammed bin Salman (MBS) to raise limits on oil production in order to lower the global cost of oil, which stood at $132 for Brent Crude on Tuesday. Although Saudi fossil fuel only accounts for about 7 percent of U.S. imports, the Saudis have spare capacity and can significantly influence the global price of fuel. However the Saudis and the other members of OPEC+, including Russia, have maintained an agreement to keep production caps in place.

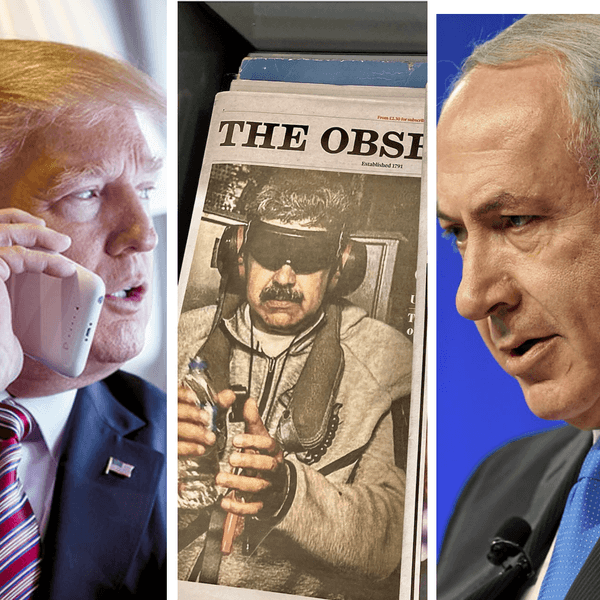

Biden has thus far refused to engage with MBS, choosing instead to interact with his ailing father, King Salman, despite MBS’s position as the de facto head of state. MBS is reportedly frustrated by this perceived snub, which reflects Biden’s desire to punish the Crown Prince for his role in the murder of journalist and U.S. resident Jamal Khashoggi as well as the brutal war on Yemen.

To be clear, the Biden administration has maintained working relations with Riyadh, including by authorizing over a billion dollars in new weapons sales to the kingdom, despite Biden’s announcement soon after taking office that he would end U.S. support for Saudi offensives against Yemen. Biden’s possible trip to Riyadh has generated critique from both the left and the right, pointing out the president’s failure to uphold his campaign pledge to make Saudi Arabia a “pariah” for the murderous policies carried out by MBS.

Biden has alternatives to increased oil production that do not require pleading with the Saudis. The administration is in talks with Venezuela about possibly and temporarily easing sanctions on the government of Nicolas Maduro in order to bring Venezuelan oil to the global market, a move that would also help pull Caracas out of Moscow’s orbit.

Reentering the Iran nuclear deal would bring Iranian oil back on the global market and lower prices. However, Putin has anticipated this and is working to impose additional conditions that may further hamstring the already lengthy negotiations.

Working with the Saudis to increase oil production represents a more familiar choice for U.S. officials, who may fear the political costs of easing sanctions on the governments in Caracas and Tehran. Yet the Democrats’ more pressing fear — losing control of Congress in the 2022 midterms and the White House in 2024 — becomes increasingly salient as American voters struggle with inflation and rising fuel costs.

Congressional Republicans have used the high price of fuel to call for increased drilling in protected American lands like the Alaskan National Wildlife Refuge. Congressional Democrats have pointed out that it would take years for the oil from new wells to come online, doing nothing to address the current price spike. As of 2020, the United States regained its former status as a net exporter of oil. Yet because the U.S. economy remains dependent on fossil fuels, even greater production of American oil would not end vulnerability to the effects of other countries’ decisions about raising or lowering production. To achieve true energy independence, the United States must transition off of fossil fuels to locally produced renewable energy sources.

Although the United States has banned the import of Russian fuels, the EU, which imports about 40 percent of its natural gas from Russia, will not follow suit. Inadequate capacity from alternative sources prevents the EU from acting as swiftly as the United States, which relies primarily on Canada for fossil fuels.

Swings in the price of oil reiterate the interdependence, and subsequent vulnerability, of the global economy. Oil prices had been low since 2014, due in part to the influx of U.S. shale oil on the global market. The price per gallon slipped below zero during the early months of the COVID pandemic, as Saudi Arabia and Russia fought a price war. Since then, Saudi Arabia has led efforts to sustain caps on production, including by pressuring the UAE not to break ranks. All oil producers, from Saudi Arabia to Texas, have incentives to keep prices high, and it is possible that even a visit from President Biden will be insufficient to convince MBS to raise production.

The Saudis and other Gulf states are increasingly hedging their bets, looking to Russia and China as rising powers, and looking to strengthen their relationships with Moscow and Beijing while seeing the United States, and Biden in particular, as a lame duck. Their calculations reflect the increasingly multipolar global order: Washington should not react by capitulating to their demands, but instead by taking steps to finally end America’s dependence on fossil fuels and reliance on the whims of rulers like MBS.