Policymakers are confused about oil, and their confusion is the basis for bad policy in the Middle East.

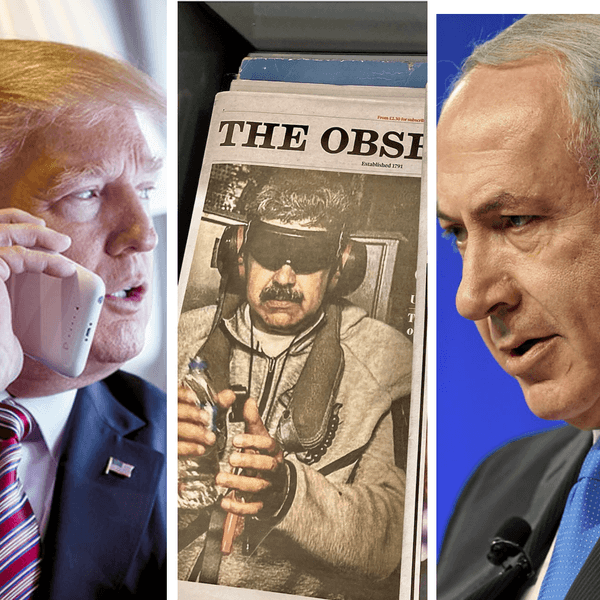

Say what they may about democracy, terrorism, or Israel, the main justification for U.S. policy in the Middle East is oil. Although policymakers generally feel squeamish about openly justifying military policy on the basis of economic interests, fear about access to oil created the basis for American involvement in the region and underpins U.S. involvement there today.

Over the past few decades, security scholars have referred to these fears as involving “energy security.” In this view, there is something about oil (or natural gas, or other sources of energy) that is different from other economic goods. Foreign policymakers worry that security competition and/or wars in the Middle East would disrupt oil supplies, and that these disruptions would have devastating consequences for world price, and for the American economy.

For their part, resource economists balk at the concept of “energy security.” Responding to energy expert and economic historian Daniel Yergin’s definition of the concept — the “availability of sufficient supplies at affordable prices” — Tufts University’s Gilbert Metcalf wonders, “what do we mean by ‘sufficient supplies’? What is an ‘affordable’ price?” They’re fair questions, and they’re ones U.S. Middle East scholars don’t answer.

U.S. oil policy hasn’t been built on precise logic in decades, and back when it was, the logic was flawed. Policymakers freaked out in 1973 when the Arab oil embargo hit, and prices roughly quadrupled over six months. In the minds of policymakers, the reason prices went bananas was because of the embargo. A basic look at cause and effect, however, shows that the Arab oil embargo did almost nothing to create the chaos in U.S. oil markets.

As my former Cato Institute colleagues Jerry Taylor and Peter Van Doren wrote back in 2003, “everything we think we know about the events [of 1973] is wrong.” As they detailed, price controls prevented large oil companies from passing price increases on to consumers at the pump, while allowing small oil companies to do so. Those price controls, intended to direct U.S. consumption toward U.S. production, worked. There just wasn’t enough U.S. production to meet the demand.

It was forgivable to conclude that the Arab oil embargo, marketed as a blow against America for its support for Israel, produced the chaos in U.S. energy markets around the same time. It was just wrong. Henry Kissinger passed off his own culpability for the bad analysis by using the passive voice in his memoir:

“The structure of the oil market was so little understood that the embargo became the principal focus of concern,” he wrote. “Lifting it turned almost into an obsession for the next five months. In fact, the Arab embargo was a symbolic gesture of limited practical importance.”

As Taylor and Van Doren concluded more sharply, “the oil weapon is a myth.”

Moreover, as the University of Michigan’s Lutz Kilian observes, “at least 75 percent of that [1973-1974] oil price increase must be attributed to shifts in the demand for oil.” This shouldn’t be terribly surprising, since Kilian notes that “there was a global demand boom in the early 1970s in all industrial commodity markets across the board, reflecting that, for the first time in postwar history, there was a simultaneous peak in the business cycle in the United States, in Europe, and in Japan.”

In other words, although nobody went berserk about copper or magnesium prices in the early 1970s, they rose alongside oil prices, as industrial commodity prices usually do.

The idea that a spike in petroleum prices could have a multiplier effect on the U.S. economy is intuitive, but looks increasingly wrong. As scholars have shown, the U.S. economy is much less energy intensive than it was in the 1970s, meaning that a unit of economic output relies on less energy than it did in the 1970s. As a consequence, the impact of price shocks in oil is less devastating than it once was. (Imagine a shock in the price of coal, for a point of comparison.)

Further, the question whether an oil price shock is economically worth preventing presupposes that the benefits of stopping one are worth more than the costs. What is the cost of the economic damage we are stopping and what is the cost of its prevention? The economic cost of the U.S. military commitment to the Persian Gulf is roughly $70 billion per year in peacetime. Do we think that normal wars and political jockeying in the region would be doing more than $70 billion in economic damage to the United States, particularly given that the United States is now a net exporter of oil? That the case is so rarely made ought to tell us something about its merits.

Energy economics can be difficult to understand, although not as difficult as the best minds in U.S. foreign policy might lead you to believe. If those of us on Team Restraint value winding down our zany commitment to the Middle East, as I outline in a recent report for Defense Priorities, we ought to take the insights of energy economists and press them on our Middle East experts. As the dean of energy economists, M.A. Adelman wrote in 2004, “U.S. oil policies are based on fantasies, not facts.” Fantasies are an unsound basis for policy.