The United States faces a stark choice in the Middle East if it continues its maximum pressure campaign against Iran: confront the Islamic republic militarily or withdraw from the region.

Trita Parsi, Executive Vice President of the Quincy Institute in Washington and a former head of the National Iranian American Council, recently drew that harsh conclusion. No doubt, Mr. Parsi may be correct in the ultimate analysis. US-Iranian tensions could easily spin out of control into an all-out war that neither Iran nor the United States wants.

There are, however, lots of shades of grey that separate long-standing tit-for-tat attacks on US targets – primarily in Iraq, occasional Iranian harassment of US naval vessels in the Gulf, and sporadic US responses, from all-out war.

The United States and Iran have been engaged in tit-for-tats with varying degrees of intensity for years and so far have avoided an uncontrolled escalation despite incidents such as the 1988 downing of Iran Air flight 655, that killed 274 people, and the targeted assassination earlier this year of Iranian General Qassem Soleimani.

Leaving aside potential black and grey swans, a more likely scenario is that a US desire to reduce its commitment to Gulf states, increased Gulf doubts about US reliability as a regional security guarantor, and a new world in which Gulf and Western states struggle to come to grips with the economic fallout of the coronavirus pandemic, create an environment more conducive to a multilateral security arrangement. One that would reduce the risk of war, even if multilateralism globally seems to be on the retreat.

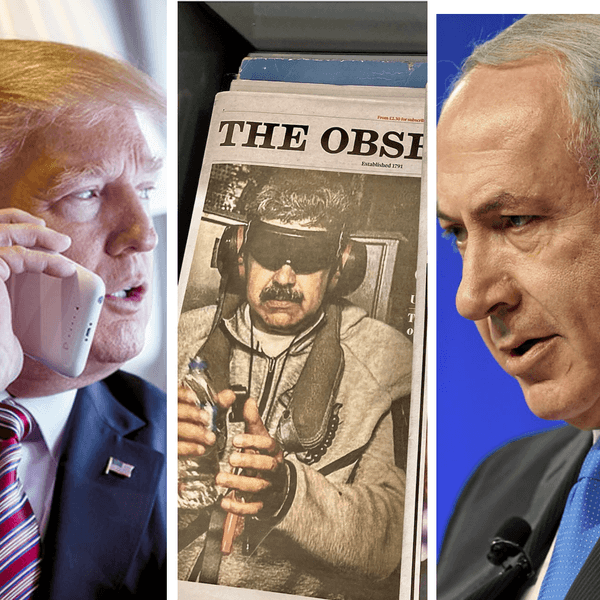

US President Donald J. Trump’s threat in early April to cut off military sales to Saudi Arabia, if the kingdom did not bury the hatchet in its oil price war with Russia – sparking the collapse of oil markets, is an inevitable epic battle for market share.

More immediately, it drove the message home in Riyadh that US security guarantees were conditional and reinforced Saudi perceptions that the United States was getting disproportionately more out of its close ties to the kingdom than Saudi Arabia.

The Trump administration, in a little noticed sign of the times, put Saudi Arabia in late April on a priority watch list for violations of intellectual property rights because of its pirating of sports broadcasting rights owned by Qatar’s beIN television franchise. The listing threatened to complicate Saudi Arabia’s already controversial bid to acquire English soccer club Newcastle United.

It is still too early to assess the geopolitical impact of the global economic downturn. Depressed demand and pricing for oil and gas could enable China to diversify its sourcing and potentially reduce its dependence on the Middle East, a volatile region with heightened security risks. China imported 31 percent more oil from Russia last month while its intake of Saudi crude slipped by 1.8 percent compared to March 2019.

At the same time, low oil prices that make US production commercially less viable could temporarily increase Washington’s interest in Gulf security.

Fundamentally, and irrespective of what scenario plays out, little will change. The US will still want to reduce its exposure to the Middle East. For its part, China will still need to secure oil and gas supplies as well as its investments and significant diaspora community in the region while seeking to avoid being sucked into intractable regional conflicts.

By the same token, the gradual revival of economic life, including a probable phased revitalization of supply chains and international travel, combined with a need to rethink migrant worker housing and create local employment, could alter Middle Eastern perspectives of China’s way of doing business.

China’s Belt-and-Road projects often have a China-wins-twice aspect to them that may have always been problematic but has become even more so in a post-pandemic economic environment. China-funded projects rely by and large on Chinese labor and materials supply rather than local sourcing.

The People’s Republic’s “China First” approach extends beyond economics and commerce. In an environment in which the United States is an irreplaceable but unreliable partner, Gulf states may look differently at Chinese hesitancy to co-shoulder responsibility for regional security with the risk of having to involve itself in multiple conflicts it has so far been able to stay aloof from.

The coronavirus pandemic constitutes a watershed that will color Middle Eastern attitudes towards all of the region’s foremost external players: the United States, China, and Russia. Prior to the crisis, Russia, the weakest of the three, was playing a weak economic hand well, but may find that more difficult going forward.

Gulf states are likely to conclude that assertive go-it-alone policies are risky and only work in specific circumstances where big powers are either part of the ploy or look the other way. Though such were easier to pursue in a stable economic environment in which their oil and gas revenue base appeared secure.

The United Arab Emirates appears to have read the writing on the wall. It began a year ago to hedge its bets by reaching out to Iran in a bid to ensure that it would not become a theater of war if US-Iranian tensions were to spin out of control. Still, that has not stopped its support for rebel forces in Libya led by renegade Field Marshall Khalifa Haftar in violation of an international arms embargo.

Mr. Trump’s threat of a cut-off in military sales to Saudi Arabia should have driven the point home. Yet, financially and economically weakened, less able to play big powers off against one another, and deprived of any viable alternative options, the kingdom and other Gulf states may find that a multilateral security arrangement that incorporates rather than replaces the United States’ regional defense umbrella is the only security straw they can hold on to.

Nevertheless, in eventually attempting to negotiate a new arrangement, they may also find that they no longer have the kind of leverage they had prior to a pandemic that in many ways has pulled the rug from beneath them.

This article has been republished with permission from Inside Arabia.