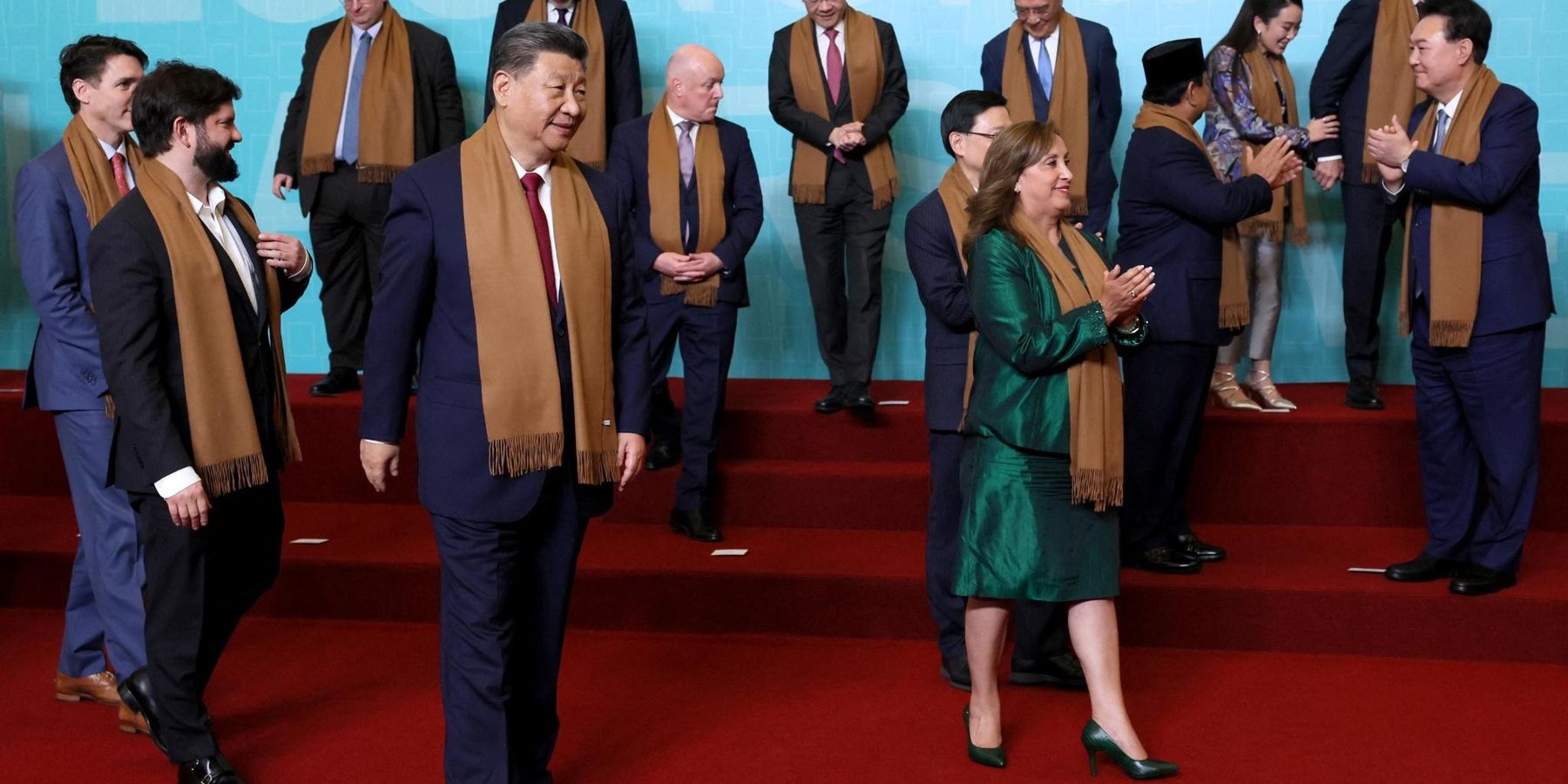

At a recently concluded summit of leaders from the Pacific Rim, Presidents Xi and Biden met in Peru against a rising tide of commentary that the U.S. is being outflanked in its own “backyard” by China.

As if to underline this narrative, Secretary of State Antony Blinken made an announcement that the U.S. was transferring used Caltrain diesel engines for a Lima suburban rail line, a day after President Xi inaugurated a deep-water megaport in Chancay built and operated by Chinese entities.

The port has sparked loud concern in U.S. military circles about a possible Chinese military presence in the hemisphere. It has also led one former NSC official who is advising the president-elect to suggest that the U.S. impose 60% tariffs on any goods entering America from Chancay.

Hovering in the background of all this concern are “scare charts” like those published in the Wall Street Journal showing how China has overtaken the U.S. as the largest trading partner for most countries in South America.

But for all the agitation, the deeper penetration of China in Latin America is largely a function of the pace and pattern of Chinese growth. China’s GDP rose from $1.2 trillion in 2000 to $17.8 trillion in 2023. And when a country with more than a billion people grows that fast, it is natural that it becomes the world's largest importer of iron-ore, copper, petroleum, soybeans and a host of other materials. And South America grows, digs, or produces a lot of what China needs.

But China’s major footprint as an importer of what South America produces also reflects that it is not as well endowed with natural resources as the U.S. There’s a reason “amber waves of grain” is a verse in “America The Beautiful.” The resource-sufficiency of North America has been a foundation of U.S. power for more than a century. And China’s role as an immense importer of commodities from the Middle East, Australia, Africa, and South America is simply the obverse.

In other words, what might feel like an eclipse is more a function of resource endowments — a fancy way of saying, “who has more stuff on or underground.” While that’s mostly a good thing, the underlying cause for discomfort may be that it’s happening in a hemisphere the U.S. has considered its “own” for 201 years now.

What about Chinese exports to the region? This too is a function of China’s growth pattern. The country has gone from accounting for roughly 5% of global manufacturing output in 1995 to about 33% now. Its exports to South America look a lot like its exports to everywhere else — electronics, consumer goods, and increasingly sophisticated capital goods and infrastructure equipment.

These are industries that migrated slowly to East Asia over the last 50 years or so, and China is just following Japan, South Korea and Taiwan. And for all the angst about China building a port in Peru — that too is just a fact of life.

Dredging, shipbuilding, port equipment design, and operation are increasingly sophisticated things that East Asia does very well. The world’s top-ranked port in terms of tonnage is Yangshan in China; the top nine ports are all in Asia. The highest-ranked U.S. port is Los Angeles in 16th place.

Meanwhile, the outcome of the recent U.S. longshoremen’s strike points to some of the political obstacles to increased automation here — perhaps not the best thing to have on a port-builder’s CV.

So when the outgoing head of U.S. Southern Command asks (referring to Chancay) why China is investing in strategic locations for global commerce, here is one plausible answer: The world’s second largest-economy, and its largest commodity importer, which also has a very good record in infrastructure and logistics buildout, is launching a container port in a country (and continent) where it is the largest trading partner.

In any event, the worries that economic links will pull South American countries into China’s political orbit are likely overstated. As Sarang Shidore, director of the Quincy Institute’s Global South Program has repeatedly pointed out, middle powers in the Global South are increasingly hedging their exposures, as only makes sense when the world’s two largest economies are at loggerheads.

Instead of hyperventilating about China in Latin America, there are more productive things Washington could be doing, particularly as it might be hard to displace China from its economic roles.

The most obvious one would be manufacturing investment that transmits technological and managerial knowhow and leads to more diversified economies. Unfortunately, the backlash within U.S. domestic politics against offshoring may make that hard to replicate at scale. Even Mexico, the “friendshorers” poster-child and a member of the US-Mexico-Canada free-trade agreement, could face tough going from tariffs as a pressure tactic over immigration and other fraught issues.

Similarly, countries like Brazil share U.S. concerns over Chinese imports and have responded with tariffs. That said, many of them are also likely to welcome inbound investment from China’s companies to service domestic markets — particularly in electric vehicles — as a way to create jobs and absorb new technologies where that country is the leader. Any pressures by Washington to exclude such investment will likely fail or backfire.

So American opportunities to enhance its influence might lie elsewhere.

South America has a long history of repeated episodes of financial distress stemming from a combination of lower commodity prices and a stronger dollar (the leading currency for cross-border lending). Financial vulnerabilities also go hand-in-hand with political vulnerability — recurrent crises have often led to alternations of left- and right-wing populisms. And decades of unhappy histories with the IMF make countries skeptical of the narrative that “debt-trap-diplomacy” is a recent Chinese invention.

But this history also creates opportunities for the U.S. to do something different. With the dollar’s centrality in the international monetary system, one undisputed U.S. superpower is finance. Treasury or Federal Reserve programs could help stabilize economies in distress. And rethinking the political and economic conditionality behind access to either U.S. or multilateral assistance could offer dividends in political goodwill.

Washington could also consider financing for strategic minerals supply chains in ways that allow countries to capture more of the downstream value-added beyond simple extraction.

Many such minerals produced in South America, like lithium or copper, are associated with the energy transition.

The change in administration might complicate questions over the American commitment to a faster and more comprehensive electrification as a key step in the fight against climate change. But if there is any such intention, it would offer a possibility to deepen U.S. economic links with South America. Even more promising is the fact that U.S. leadership in fracking technology also means expertise in geothermal energy projects that would be very welcome here.

America still has a great deal to offer a region which, like much of the global South, wishes to avoid being corralled into a side in the U.S.-China rivalry. So rather than overreact to the elementary facts of economic complementarity that explain China’s presence, the U.S. should just focus on what it can do best.