Defense contractor L3Harris announced Sunday that it plans to acquire Aerojet Rocketdyne for $4.7 billion in a move that would cement the firm as one of America’s leading arms makers.

It’s unclear if the deal will go through, especially given that the Federal Trade Commission recently torpedoed Lockheed Martin’s attempt to purchase Aerojet Rocketdyne on antitrust grounds. Due to potential national security concerns, the Pentagon will also have a chance to block the move.

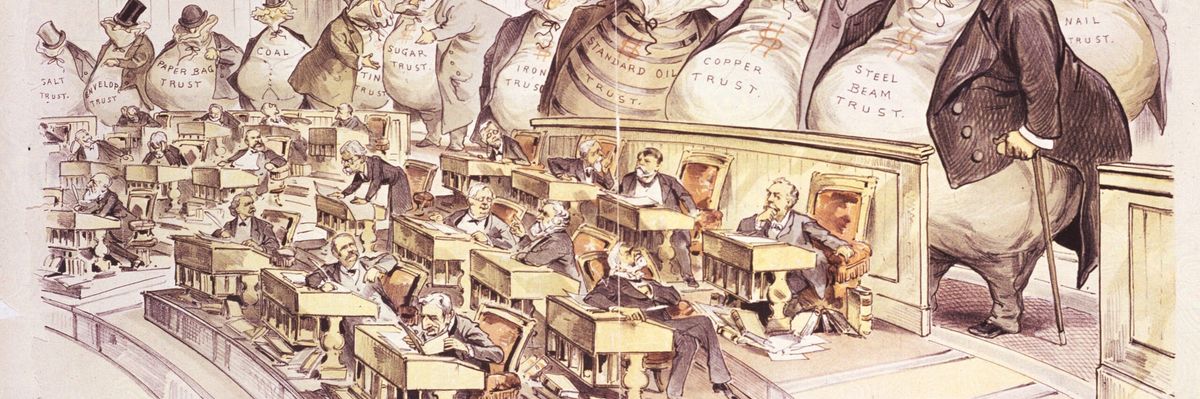

But, assuming it does clear these bureaucratic obstacles, the deal will represent a significant step in the decades-long consolidation of the defense industry — a trend that risks driving up the military budget while slowing innovation, experts say.

As the Pentagon recently noted, the number of defense prime contractors has plummeted from 51 to five since the 1990s. And nearly 20,000 small businesses have been pushed out of the defense market in the last decade alone, according to the Government Accountability Office.

With fewer companies competing for contracts, observers worry that defense firms will engage in price gouging, leaving taxpayers to foot the bill. (Some companies, like Boeing and Transdigm Group, have already been caught overcharging for parts.) Rapid consolidation can also discourage companies from investing in the types of innovative technologies that the United States will need to defend itself from future threats, according to military analyst Mark Thompson of the Project on Government Oversight.

“Innovation requires the levers of competition to work,” Thompson wrote in 2019 following Raytheon’s merger with the defense division of United Technologies Corp. “Competition drives the perpetual quest to get more bang for the buck by harnessing new technologies.”

In some ways, the Aerojet deal is a perfect illustration of the ever-shrinking defense industry. L3Harris has ridden a wave of mergers and acquisitions to become the sixth largest weapons contractor in the United States and the 13th in the world, according to a recent report from the Stockholm International Peace Research Institute.

This process began back in 1997, when a group of defense industry veterans teamed up with Lehman Brothers to found L-3 Communications. Their first move was to acquire a few divisions of Lockheed Martin, which had only recently formed as the result of a merger between Lockheed Corporation and Martin Marietta.

L-3 Communications then went on something of a shopping spree, buying as many as 30 companies between 1997 and 2017. Given this ever-expanding portfolio of businesses, the firm’s leadership decided in 2016 to change its name to L3 Technologies.

But all of this was the prologue for L3’s most ambitious decision: its 2018 merger with Harris Corporation, a leading surveillance and electronic warfare company. Following that deal, newly-minted L3Harris quickly rose to its current spot as one of the biggest defense contractors in the world.

Meanwhile, Aerojet and Pratt & Whitney Rocketdyne, both of which made rocket propulsion systems, came together in 2013 to create Aerojet Rocketdyne. The company is now one of only two U.S.-based firms that produce rocket motors at large scales, leaving little competition for a crucial component in many weapons. (Northrop Grumman, the world’s fourth largest weapons maker, bought the other leading rocket propulsion company in 2017.)

Notably, the Aerojet acquisition is not the only big move that L3Harris has trumpeted in recent months. In October, the company announced that it planned to purchase Viasat’s military communications unit for a cool $2 billion in a deal that is set to close next year.

In an interview with the Wall Street Journal, L3Harris CEO Chris Kubasik described the recent moves as an attempt to shake up the defense industry. “We want to be the disrupter,” Kubasik said.

For all this talk of disruption, L3Harris has grown thanks to the same playbook as its peers: namely, buying up companies until the government feels the need to yell “Stop!” Now, it’s up to regulators to decide whether that moment has come.