In June 2020, the United States government implemented the Caesar Syria Civilian Protection Act — a.k.a. Caesar Act — which imposes sweeping sanctions on Syria. These sanctions, which are the harshest that Washington has ever imposed on the Assad regime, target entities or individuals which are involved in any activities within sectors of the Syrian economy that the government dominates, including banking, military, gas, oil, construction, and engineering. To date, the main effect of the Caesar Act has been to deter foreign investors from contributing to Iranian and Russian reconstruction plans for Syria. The Caesar Act does not directly target any members of the Gulf Cooperation Council, or GCC. However, the ripple effect of these U.S. sanctions could undermine the growing interest of the United Arab Emirates on the Syria issue.

The UAE’s unique post-2011 approach

Ties between the government in Damascus and most GCC states started to deteriorate soon after the “Arab Spring” broke out in Syria nearly a decade ago. With the exception of Oman, all GCC states gave support to Syria’s dominant opposition force — the Free Syrian Army — and severed relations with the Syrian regime. Saudi Arabia and Qatar were the biggest backers of the anti-Assad rebellion. GCC efforts also led to the expulsion of Syria from the Arab League in 2011.

Yet within the GCC there were different perspectives on events in Syria. The UAE, while officially opposed to Assad’s government at the beginning of the conflict, was far less supportive of the rebellion than either Riyadh or Doha due to the fact that Abu Dhabi understood that the Muslim Brotherhood and other Islamist factions were in a strong position to take power in a post-Assad Syria.

Abu Dhabi’s Crown Prince and de-facto leader of the UAE Mohammed bin Zayed Al Nahyan, known as MbZ, was deeply unsettled by the rising prominence of Islamist groups in Tunisia and Egypt following the revolutions that successfully toppled the regimes in both countries. MbZ came to consider the 2011 uprisings and the rise of Islamist groups affiliated to the Muslim Brotherhood as major threats for all the long-time rulers of the Middle East, including himself, and for the stability of the regional status quo.

The proliferation of Islamist rebel groups within Syria prompted UAE policymakers to reduce arms transfers to rebel forces. Between 2012 and 2013, the UAE also offered asylum to prominent female members of the Al Assad family such as Bushra Al Assad and Anisa Makhlouf, respectively the sister and the mother of the Syrian President. Put simply, the UAE was more concerned about Sunni Islamists running Damascus than the Assad government surviving.

Syria in Abu Dhabi’s plans

Abu Dhabi’s less hostile stance towards the Syrian government during the country’s internal conflict is certainly paying its dividends now that the UAE is increasingly focused on opposing the foreign policy of by Turkey’s president, Recep Tayyip Erdoğan, and against Muslim Brotherhood-affiliated groups supported by Ankara. Indeed, the resumption of full diplomatic relations between Abu Dhabi and Damascus following the 2018 reopening of the UAE embassy in the Syrian capital is part of MbZ’s plan to bring Assad’s Syria back into the Arab fold in an effort to build a front of Arab states which unite against Turkey.

Tensions and growing hostility between Turkey and Syria escalated in March 2020 as Damascus launched a military offensive against Turkish-backed rebels to recapture Syria’s Idlib province—the rebels’ only remaining stronghold in the country—prompting Ankara’s military intervention to push back Assad loyalists. Certainly, such escalation has contributed to Abu Dhabi’s intensification of its diplomatic engagements with Damascus and to the UAE’s decision to provide Syria with medical supplies to cope with Covid-19. The fact that the Syrian regime is Iran’s closest Arab ally also demonstrates that Abu Dhabi is willing to cooperate with Tehran and against Ankara in areas in which this is possible.

Financial diplomacy

Assad’s main external supporters, Russia and Iran, are both currently unable to finance expensive reconstruction projects, as much of Syria has been devastated by its civil war, and are increasingly looking for partners to share this burden with. In this context, the UAE has emerged as the bridgehead of the GCC when it comes to the prospect of the Syrian regime and wealthy GCC states normalizing ties. Such prospect would certainly be welcomed by Moscow. Russia has been seeking GCC cooperation for its Syria reconstruction plans, but so far without success.

Given the circumstances, the UAE’s financial involvement in Syria and its efforts to mediate between Damascus and other potential financial donors in the GCC could have an important diplomatic dimension and strengthen the Abu Dhabi-Moscow partnership on other regional matters, such as Libya, where Russia and the UAE are engaged in a proxy war against Turkey. The willingness of both Abu Dhabi and Moscow to strengthen bilateral coordination was evidenced by the February 2020 visit to the UAE of the director of Russia’s Foreign Intelligence Service, Sergey Naryshkin.

Furthermore, over the past two years, contacts between Syrian and Emirati businesses have multiplied. In September 2019, an Emirati business delegation visited Syria to attend the 61st Damascus International Fair, despite Washington’s opposition.

Challenges ahead

In their recent history, the UAE and other Gulf states have largely fallen in line with U.S. foreign policy preferences. Indeed, Abu Dhabi continues to consider Washington its most important international partner. Thus, the prospect of U.S. sanctions related to the Cesar Act threatens a negative combination of economic losses and political challenges that is discouraging the UAE from potentially very significant further engagement in Syria.

Arguably, the UAE’s willingness to engage with the Syrian regime despite these potential negative implications, especially with the risk of upsetting Washington, demonstrates the extent to which MbZ is keen to consolidate an anti-Turkey front.

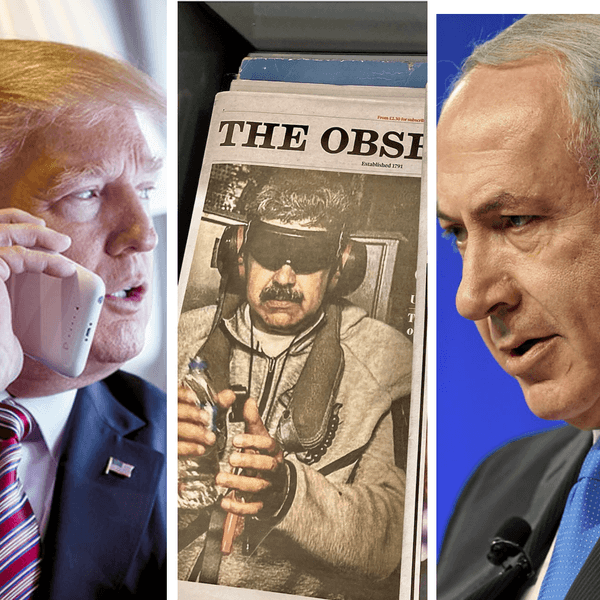

Currently, the chaotic transition following the victory of Democratic candidate Joe Biden in the 2020 U.S. presidential election could represent an important window of opportunity for Abu Dhabi to continue with its plans for Syria while avoiding in-depth scrutiny from the White House. The UAE can also rely on the fact that it recently obtained bipartisan gratitude from Washington’s political establishment as a result of the Abraham Accords signed with Israel.

However, from January 2021 onwards, it can be expected that a Biden administration will remain committed to implementing the Caesar Act and stand by the principle of punishing traditionally hostile regimes responsible for gross and evident human rights violations, forcing Abu Dhabi to strike a complicated balancing act between the desire to rehabilitate Damascus and the need to maintain close political ties to Washington — especially avoiding the long reach of the U.S. Treasury Department.