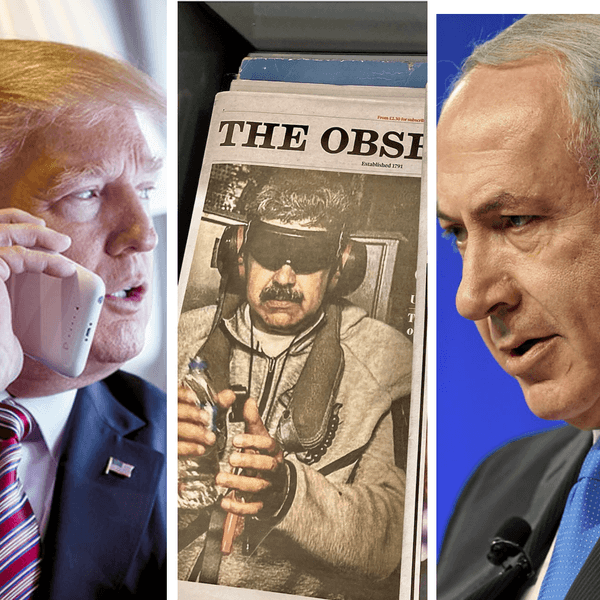

Over the weekend, Iran launched over 300 missiles at Nevatim Air Base, a base in southern Israel that houses U.S.-made F-35 fighter jets. Israeli Prime Minister Benjamin Netanyahu, who oversaw a strike on an Iranian consulate in Syria just a few weeks ago, has already promised to retaliate. Observers viewed these brewing tensions with concern, ringing the alarm bells of the breakout of a wider war.

Not JP Morgan analyst Seth Seifman. On Monday morning, Seifman upgraded JPMorgan’s outlook from “hold” to “buy” for Lockheed Martin, the manufacturer of Israel's F-35s, and set a higher price target for the stock.

Seifman says the change was pre-planned, but noted that these developments could be good for business. “What we can say is that it’s a dangerous world and while that is not a sufficient condition for defense stocks to outperform,” he said, “it is a potential source of support, especially when they are under-owned.” JP Morgan owns $355 million worth of Lockheed Martin stock, about a third of which was bought in the last quarter of 2023.

UK investment bank Liberum Capital was similarly bullish on defense stocks, so long as a wider war does not break out. “In our base case scenario of Israel retaliating but in a limited way that keeps the conflict from escalating further, this could lead to a 5-10% correction in the stock market together with further strength in the U.S. dollar,” Liberium told investors. “The obvious short-term winners will be oil & gas stocks as well as defense contractors.”

As finance journalist Jacob Wolisnky put it in a recent preview of defense stock picks, “Where there’s war, there’s money to be made.” At least one member of Congress agrees. Yesterday, Rep. Kevin Hern (R-Okla.) disclosed that he bought Lockheed Martin stock on March 29.

Lockheed Martin has played a large role in Israel’s bombing and invasion of Gaza, manufacturing Hellfire missiles, providing transport planes, and supplying F-16 and F-35 fighter jets. A missile that hit journalists on November 9 of last year in Gaza City was reportedly manufactured by Lockheed Martin. “Their core business model has no respect for human rights,” said Jilianne Lyon, who leads shareholder advocacy campaigns at Investor Advocates for Social Justice.

While privately acknowledging conflict is good for business, the defense industry and its financiers publicly claim they are simply doing America’s bidding. As Lockheed Martin CEO James Taiclet once said, “It's only up to us to step to what we've been asked to do and we're just trying to do that in a more effective way, and that's our role.” After all, it was the U.S. government — not Lockheed Martin — that came to Israel’s defense and intercepted the majority of Iran’s missiles.

But this “we just do what we’re told” defense doesn’t quite work given that defense contractors are actively shaping U.S. foreign policy through lobbying and campaign contributions, among other tactics. Aaron Acosta, program director at Investor Advocates for Social Justice, told Responsible Statecraft that defense contractors “are often the ones creating demand by lobbying the U.S. government and pushing for sales of these weapons.”

In 2023, Lockheed Martin spent over $14 million lobbying Congress. The three companies that lobbied the House’s version of the annual defense policy bill the most were RTX (formerly known as Raytheon), Lockheed Martin, and General Dynamics. During the 2022 election cycle, Lockheed Martin contributed nearly $4 million to political candidates. So far, 2024 promises similar results. In its 2023 annual report, Lockheed Martin wrote that, “Changes in the U.S. Government’s priorities, or delays or reductions in spending could have a material adverse effect on our business.”

Sure, 84% of voters might be concerned about the U.S. being drawn into conflict in the Middle East. But as far as defense companies and their shareholders are concerned, business is booming.

- Where have you gone, Smedley Butler? ›

- Wall Street eyes big profits from Israel-Hamas war ›

- Wear the war machine with Lockheed Martin merch | Responsible Statecraft ›