Russia has spent the past five months swallowing up ever bigger tracts of Ukrainian coal, lithium, and uranium in the Donbass. Yet Western politicians still cling to the belief that they will be able to tap these resources to repay Ukraine’s ever mounting pile of debt. This is economic madness.

In the summer of 2024, most Western politico-military commentators were predicting that Russia was focussed on storming the strategically important military hub of Pokrovsk in Donetsk. Russian troops had advanced slowly, inexorably westward in a straight line following the bloody attritional battle for Avdiivka which was captured in February 2024.

But from August, Russian tactics shifted. First from the south of Donetsk they stormed Vuhledar, literally translated as “Gift of Coal,” a site of significant reserves, capturing it on October 1. That opened the way to swallow up large swaths of land in the south. Following the apparent encirclement of Velyka Novosilka in the past two days, one of Ukraine’s three licensed blocks of extractable lithium is now within short reach in Shevchenko.

Russian armed forces skirted Pokrovsk, instead battling through Selydove and in a straight line for about 20 miles, capturing a Uranium mine in a village called Shevchenko (not the same Shevchenko where the lithium is located). In recent weeks, Russian forces have taken Ukraine’s most important mine for coking coal in Pishchane and two related coking coal shafts in Udachne and Kotlyne. Together, these mines alone had produced the coking coal for 65% of Ukraine’s steel production. There are now fears that Ukrainian steel production could plummet to 10% of its prewar level in 2025.

Since President Trump was elected in November, and the prospect of an enforced ceasefire grew brighter, Russia’s advance has progressively accelerated. Today it is on the verge of completing its capture of the coal-rich bastion of Toretsk, the only town on the line of contact that hadn’t moved since 2014.

That’s bad news for Ukraine, not just because of a potential loss of further territory.

Prior to the crisis in Ukraine starting in late 2013, the extractives sector accounted for over a third of total exports, with agricultural products a third of that value. Today, the situation has been flipped, with agriculture by far the largest export sector.

By capturing every coal, uranium, and lithium mine that they can, Russia is cutting off an important source of Ukrainian wealth. Ukraine faces deeper current account deficits as its agriculture sector is unable to make up the difference for lost exports of minerals, especially with President Zelensky wanting to give away Ukrainian grain to Syria.

Fitch ratings has predicted Ukraine will record current account deficits of 6.5% of and 5.7% of GDP respectively in 2024 and 2025.

As I have pointed out before, with Ukraine still cut off from international lending markets because of its junk sovereign credit rating, that means the only way it can make up the difference is foreign aid or loans from foreign governments. With debt now about 100% of GDP, Ukraine has had to dip into the domestic bond market.

However, as Ukrainian banks are largely state owned, that amounts to borrowing from itself. Ukraine’s central bank governor has denied that the country will need to print money in 2025 to keep the lights on. If it does, hyperinflation and a collapse of the hrynia will beckon, rendering Ukraine’s debt impossible to pay, at which point Western governments will need to bail the country out.

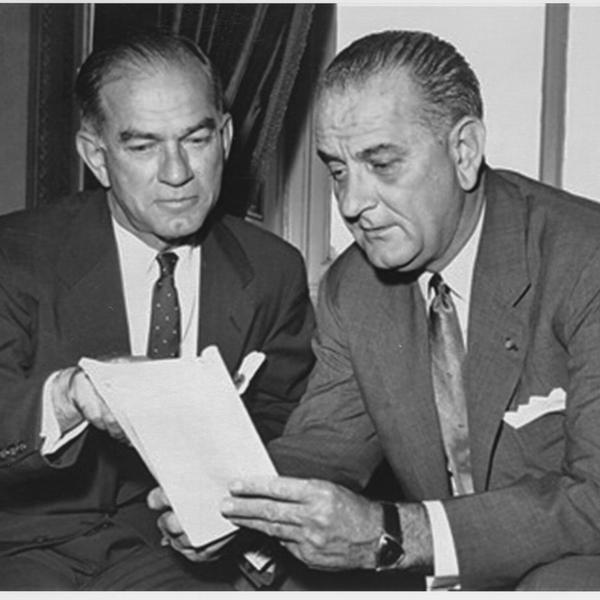

Fear not, though, as Western politicians have a cunning plan to repay Ukrainian debt. Sen. Lindsey Graham (R-S.C.) has been outspoken this year in saying that Ukraine could pay back U.S. loans with its mineral wealth. He first raised this in a CBS interview in February 2024 as Congress worked hard to unlock former President Biden’s $61 billion aid package to Ukraine. He repeated this position one month later in Kyiv. Standing beside President Zelensky, he said, “they’re sitting on trillion dollars of minerals that could be good for our economy.”

A month later, Congress passed the long-delayed $61 billion U.S. aid package to Ukraine. That included just $9 billion in forgivable loans, short of the two-thirds Sen. Graham had hinted at in February.

Nonetheless, it marked another step on the road towards shouldering more debt onto Ukraine in the belief that this might one day be repaid in Ukrainian uranium, lithium, and other bountiful minerals. This was solidified by the G7 Extraordinary Revenue Acceleration loan of $50 billion agreed in June 2024, to which the United States contributed $20 billion at the end of 2024.

During this same period, the shift in focus towards Ukraine giving up its natural resources to secure Western aid gathered steam. In October 2024 when President Zelensky unveiled his so-called victory plan, giving up Ukraine’s natural resources became codified. He claimed that Ukraine would sign an agreement with the U.S., EU and others that would allow for use of Ukraine's natural resources, which were worth “trillions of dollars.”

Just last week, shortly before President Trump’s inauguration, British Prime Minister Keir Starmer penned a “100-year partnership deal” between the United Kingdom and Ukraine. While the document has yet to be made public, 10 Downing Street said that it would cement the UK as “a preferred partner for Ukraine’s energy sector, critical minerals strategy and green steel production.”

US and UK politicians see great potential profit in accessing Ukraine’s wealth when war finally comes to an end, with Forbes Ukraine valuing minerals at $14.8 trillion.

However, just over half of that is located in the four eastern Ukrainian regions that Russia has occupied and where it gains new ground each day.

Back in August, in a typically foul-mouthed tirade, former Russia President Dmitry Medvedev took to his Telegram channel, among other things, to pillory Sen. Graham, who he called a “fat toilet maggot.” He continued, “To get access to the coveted minerals, the Western parasites shamelessly demand that their wards wage war to the last Ukrainian... ‘You’ll have to pay off your debts very soon. Hurry up, dear friends!’”

Leading European politicians still urge Ukraine to continue its war using credit in the hopes it might be repaid with a stock of natural resources that Russia captures with ever greater speed and covetousness. That is the economic equivalent of Russian roulette with a fully-loaded revolver that President Putin is gladly pointing at us.

President Trump’s efforts to end this madness can’t come soon enough.

- Ukraine war ceasefire may require accepting a partition ›

- Trump may get Russia and Ukraine to the table. Then what? ›

- Trump wants Ukraine's minerals in exchange for aid | Responsible Statecraft ›