Among the many elements of the draft National Defense Authorization Act (NDAA) currently being debated in Congress is an amendment that would reauthorize the Development Finance Corporation (DFC). What it might look like coming out of the Republican-dominated Congress should be of interest for anyone watching the current direction of foreign policy under the Trump Administration.

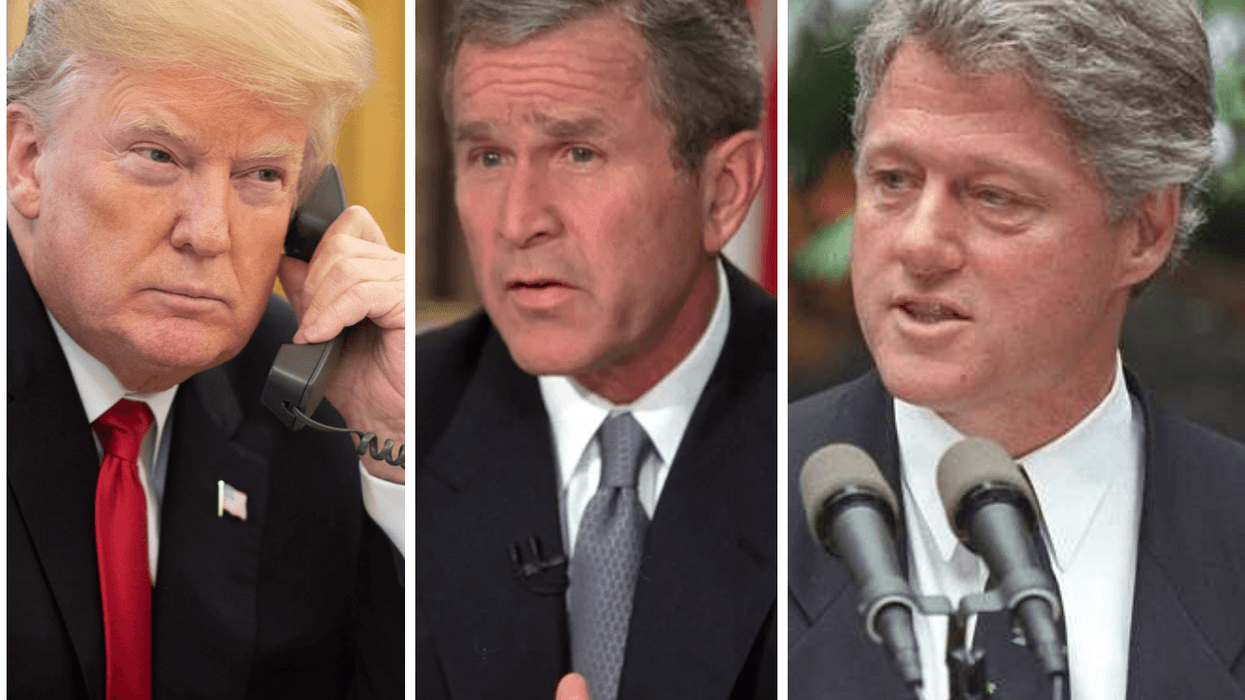

In contrast with America’s other major development agencies like the U.S. Agency for International Development (USAID), which the administration has largely dismantled, President Donald Trump has expressed support for a reauthorized DFC but wants to broaden the agency’s mandate so that it focuses less on investing in traditional development projects and more on linking investment to national security priorities.

But doing so risks distracting the DFC from its original mandate of building market capacity in poorer nations, instead priming it to advance potentially hazardous security policy rooted in Great Power Competition between the U.S. and its Russian and Chinese rivals.

So what is the DFC and why does this new direction matter? The DFC is an independent American government agency that supports private sector investment in low- to middle-upper-income countries around the world in an effort to advance American statecraft. Unlike USAID, which met its mandate primarily by issuing grants, the DFC uses financial tools that can earn revenue for the American Treasury.

It does this by using advanced financial mechanisms to encourage private sector investment in places where, due to high risk and potentially low returns, private actors would be unlikely to make investments on their own. The DFC offers insurance coverage to prospective investors and even takes partial ownership of business ventures in developing countries. This way, it uses its own funding and expertise to reduce risks and help manage projects in countries with poor macroeconomics and geopolitical conditions that could make it difficult to return a profit.

The DFC has been awaiting renewal since its funding lapsed in early October, and two competing bills in Congress have been brought forth to this end. Sen. James Risch (R-Idaho) introduced an amendment to the NDAA that, while massively expanding the DFC’s size, retains some of the guardrails that can help keep the DFC’s focus on purely development initiatives. Rep. Brian Mast (R-Fla.) separately introduced a House bill that more closely aligns with Trump’s desire to use the agency as a lever to help advance Trump’s foreign policy, including on a number of security issues not connected to traditional development. With the NDAA approaching passage, it appears likely that that version of a reauthorized DFC will soon become law.

The reauthorized DFC that emerges from the legislative process will be much bigger than it is at present, but the tone of discussion in recent months raises questions about the “new” DFC’s purpose and operations. A recent Quincy Institute brief we authored, entitled “Investing in the National Interest: The DFC and American Statecraft,” explores the subject in greater detail.

While there are political divisions on the required degree of oversight and the extent to which the DFC should be required to retain a focus on poorer countries, bipartisan support for a more powerful agency is grounded in a desire to use it as an instrument in great power competition.

Such motives are likely to influence the choice of sectors and geographies where the DFC operates and the partners that it chooses for projects. The need to focus the DFC on critical minerals exploration and extraction, particularly in the Global South, has become a staple in discussions about the DFC. Indeed, the agency describes itself as “investing in projects that counter China’s presence in strategic locations and bolster supply chains of critical minerals.” The perceived importance of ensuring the supply of critical minerals has only increased in the aftermath of China’s recent tit-for-tat imposition of export controls on rare earths.

However, while ensuring the resilience of key material supply chains is clearly in America’s national interest (to forestall, among other things, a repeat of the recent episode of Chinese coercion on rare earths), an overly hard-edged vision of the DFC’s mission that is framed substantially in exclusionary national security terms could contribute to a backlash that reduces U.S. influence in the Global South. A DFC role in extracting resources key to American security may be welcome in developing countries, but the developmental impact on the country and the diplomatic benefits for the U.S. are likely to be greater if paired with other investments that benefit a larger population.

One example of an approach that combines Washington’s interest in secure mineral supply chains with a broader developmental impact is the DFC’s $550 million investment in the Lobito Corridor project. The central element here is the rebuilding of a railroad line connecting mineral rich areas in the Democratic Republic of Congo (DRC) with the Angolan coast, but it is coupled with other projects including metal-processing (which allows the local economy to capture more of the value than mere extraction) and infrastructure that enables agricultural exports.

A related risk to America’s reputation comes from the possibility of reduced transparency from the removal of guardrails on DFC activity. Among the bills under consideration, the version favored by the White House seeks to raise the threshold for congressional notification about DFC deals from $10 million to $100 million, which would reduce congressional oversight. It also allows the DFC free rein to invest in countries regardless of how wealthy they are, allowing the deployment of public American capital in countries with ample ability to raise it themselves. Together, the removal of guardrails could open the door to corruption at home and abroad. Disputes over this issue have dogged the reauthorization process thus far, but could soon be resolved through a compromise on the extent of investments in high-income countries.

A framing of the DFC’s mission that pushes too hard in the direction of excluding America’s rivals or securing one-sided gains for the U.S. could backfire by treating countries of the Global South solely as pawns in great power competition and denying both their agency and their developmental aspirations. Alternately, the DFC could just engage in a vigorous commercial competition with its rivals that delivers mutual benefits to the U.S. and its project and partner countries, while simultaneously taking global geopolitical tensions down a notch.

A DFC that focuses solely on megaprojects could also have other drawbacks. In financial terms, smaller projects are also likely to generate revenues more quickly than larger-scale ventures with long lags to completion. A more balanced portfolio can thus help generate cashflow for an agency that is expected to serve the national interest while also delivering returns to American taxpayers.

A more expansive DFC mission could be especially useful in Latin America and the Caribbean. Here, U.S. worries about national security go well beyond things like access to critical minerals or concerns about China’s presence in the region, even if these subjects seem to arouse the most anxiety in Washington. Concerns about migration and crime play a big role in the U.S. approach to the region, and the DFC could address these by pursuing small- and medium-scale development projects that increase economic opportunities for the bulk of the population.

As Congress hurries to close its unfinished business before the holidays, it will almost certainly reauthorize the DFC before the end of the year. Unfortunately, it seems more likely to do so in a way that takes a narrower view of America’s national interests when it comes to global development.