Unprecedented political protests in Cuba on July 11 have forced the issue of Cuba policy to the top of President Biden’s agenda after it languished for months on the backburner. On July 19, the administration announced that it was forming a Working Group on Remittances to explore ways to enable Cuban Americans to help their families on the island.

However, as a senior official told The Hill, “The administration is focused on only allowing such transfers if we can guarantee that all of the money flows directly into the hands of the Cuban people instead of allowing a portion of the proceeds to be siphoned off into regime coffers.” That echoes what President Biden himself said a few days earlier when he expressed his reluctance to lift President Trump’s sanctions on remittances for fear “the regime would confiscate those remittances or big chunks.”

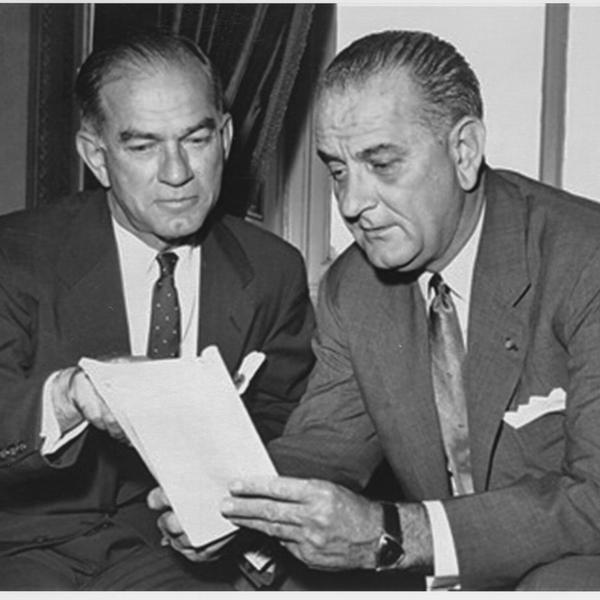

Sen. Bob Menendez, an outspoken critic of restoring remittances, has been in direct contact with the White House urging the president not to lift Trump’s sanctions. In a Senate Foreign Relations Committee Hearing on May 19, Menendez claimed that the Cuban government was “taking 20 percent of remittances to Cuban families, then converting the balance of the remittance to Cuban pesos that are worth a fraction of what Americans send to their families, that can only be used at state-owned stores.”

That is an inaccurate, outdated account of how the flow of remittances works, who benefits, and how the Cuban government uses the dollars that flow into the country. Before July 2020, the Cuban government did capture the lion’s share of remittances. In 2004, it began charging a 10 percent tax on US dollars coming into Cuba in the form of cash. Cuban officials justified this as necessary to cover the cost of circumventing the U.S. embargo to use dollars in the international financial system. The tax did not apply to wire transfers of dollars, or to other convertibles currencies, so Cuban Americans could avoid it entirely by using these other options.

From 2004 to 2020, dollars were not legal tender in Cuba, so Cubans had to exchange dollars for Cuban convertible pesos, or CUC, to spend them, an exchange for which the government charged a three-percent fee. A Cuban could then use CUC to buy certain imported goods, mostly durable consumer goods that were only available for purchase in convertible pesos. The mark-ups were notoriously high—upwards of 200 percent.

Adding up all the fees and markups, it was fair to say that the Cuban government was extracting more than half the real value from dollar remittances. But that changed in July 2020.

The Cuban economy was in recession amid the pandemic, and the government was short of foreign exchange currency to import basic necessities. To create more of an incentive for Cuban Americans to send remittances, the government abolished the 10 ten-percent tax on dollars entirely. Today, Cubans can deposit remittances in a debit card account and can use the card in stores that sell goods priced in dollars. There is no 10 percent tax, no requirement that dollars be exchanged for Cuban pesos, and no exchange fee.

For now, Cubans who have dollars in cash and want to exchange them for pesos cannot do it officially. The banks are not taking cash dollar deposits because the government has trouble spending U.S. currency abroad due to Washington’s unilateral financial sanctions. But Cubans can exchange their dollars for pesos on the street at almost triple the official exchange rate.

Markups in the hard currency stores, especially for basic consumer staples, are much reduced from what they were in the CUC stores. This is the result of market forces, not the government’s benevolence. Before the pandemic, entrepreneurs travelled abroad to buy consumer goods, bringing them back to Cuba and selling them privately at prices below the CUC prices in state stores. An estimated 25 million dollars per month in foreign exchange currency was leaving the country through these private channels. The competition forced the government to reduce prices in the state stores to win back market share.

As a result of the July 2020 policy changes, the only profit the Cuban government currently makes on remittances wired to Cuba is this markup on goods sold in the hard currency stores.

What does the government do with the money? The dollars it takes in flow right back out to finance imports. First, the government has to import goods to restock the shelves in the hard currency stores. The profit from the stores finances general imports, about a third of which are food and other consumer goods, and another third are fuel. (Cuba imports 70 percent of its food and 59 percent of its fuel.)

Fifty-six percent of Cuban families received remittances before Trump’s sanctions; the rest depend on social assistance or their ration cards to buy food and other staples at low prices subsidized by the state, a 30 billion peso annual expense for the government (worth about 1.25 billion dollars at the official exchange rate of 24:1). A high-end estimate of the remittances going to Cuba before Trump closed the spigot was 3.5 billion dollars, so whatever profit the government is earning in the hard currency stores is certainly less than what it spends to import the basic goods it provides at subsidized prices to Cubans who don’t receive help from family abroad.

In short, the Cuban government is not gaining windfall profits from remittances. There is no way to prevent the Cuban government from receiving those dollars when Cuban recipients spend them, so if that’s the condition the Biden administration envisions, then nothing will change. But if the goal is simply to assure that the government is not extracting value in excess of normal business expenses, then that condition is already being met.

President Biden says he “stands with the Cuban people.” Immediately reopening the channel for Cuban Americans to send remittances to their families is the single most important thing he can do to prove it.