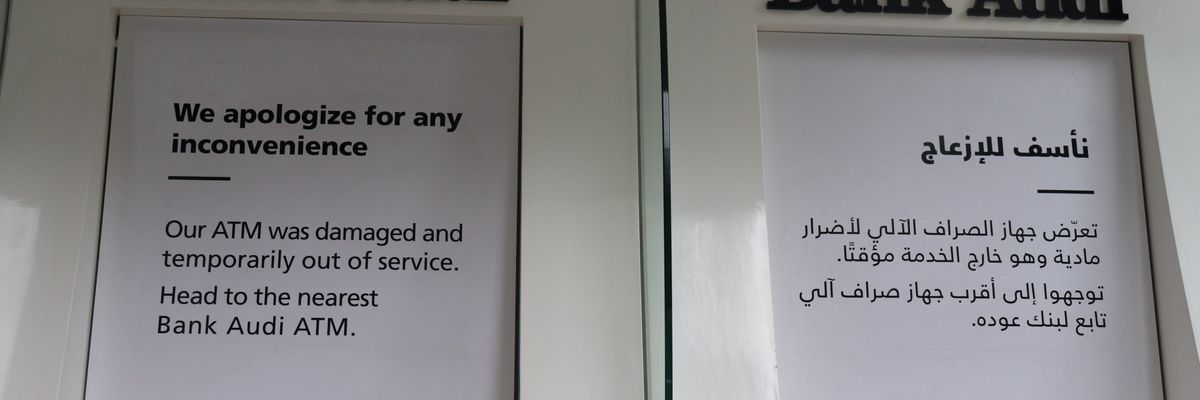

BEIRUT — There is just one ATM working in Mar Elias, one of Lebanon’s longest shopping streets, running from the busy Rue Independence down to Corniche al-Mazraa. All the rest were wrecked last weekend by protestors with hammers and spray-paint.

Three months after demonstrations erupted in what is now known as al-thawra (“the Revolution”), a new government was announced on Tuesday. Despite the venom directed at politicians and banks, little is being said by new ministers, their political opponents, or by protestors as to how the country can emerge from a growing fiscal, currency, and banking crisis.

The government led by 60-year-old engineering professor Hassan Diab has appealed to international donors for $4-$5 billion in soft loans to facilitate imports of wheat, fuel and medicines. At best this is a short-term palliative: Lebanon’s public debt of $87 billion, more than 150 percent of the GDP, continues to increase as the result of a government deficit of around half its revenue.

United States Secretary of State Mike Pompeo was cagey when asked by Bloomberg if Washington will support the Diab government given it includes Hezbollah, the Lebanese Shiite party allied to Iran. On Thursday in Davos, U.S. Treasury Secretary Steve Mnuchin said the U.S. “was speaking with the [Beirut] government about various different economic alternatives.”

Pompeo drew a parallel with protests in Baghdad, suggesting neither were “anti-American protests…[but] protests demanding sovereignty and freedom.” He claimed protests in Lebanon were aimed against Hezbollah rather than against the entire ruling political class that has run up the $87 billion debt or against the Lebanese banks that have largely financed it.

“The protests taking place today in Lebanon are saying to Hezbollah, ‘No mas.’ No more,” said Pompeo. “We want a non-corrupt government that reflects the will of the people of Lebanon. If this government in responsive to that and there’s a new set of leaders that’s prepared to make those commitments and deliver on that, that’s the kind of government that we’ll support.”

Could a government supported by Hezbollah make “such commitments” to the satisfaction of the Trump administration?

Skeptics will point to its steadily strengthening sanctions against Hezbollah, including the party’s deputies elected to Lebanon’s parliament. Pompeo this week called on “all nations” to follow the U.S. in classifying Hezbollah as a “terrorist” group following a decision by the United Kingdom government to add the party, and not just its military wing, to its “terrorism” blacklist.

A long-standing U.S. position, shared with Europe, makes international aid to Lebanon dependent on the government taking serious steps to reduce the deficit and curb rampant corruption. Lack of progress means an international aid package of $11 billion, mainly loans, agreed to in Paris in 2018 has yielded nothing.

But two things have changed in recent months. First, the financial and banking imbalances have reached a tipping point. The Central Bank has effectively allowed a 33 percent devaluation of the Lebanese pound while banks have since November imposed de facto capital controls limiting withdrawals, especially of dollars. Inflows from the sizeable Lebanese diaspora have dried up.

Second, domestic politics has fractured, upsetting the usual Lebanese practice of forming governments with all — or nearly all — parties allocated positions, a consensual practice designed to ensure representation of Lebanon’s various Muslim and Christian sects.

Instead, many of Lebanon’s political parties have refused to join a new government after that of Saad al-Hariri, who leads the main Sunni Muslim party Mustaqbal, resigned as prime minister following the outbreak of al-thawra in October.

Oddly, this leaves some of the parties most responsible for the Lebanese economic strategy — based on high government spending financed by Lebanese banks — refusing to join a government dominated by Hezbollah and its Christian ally, the Free Patriotic Movement led by president Michel Aoun. Neatly, this absolves them from putting forward clear proposals for tackling the financial crisis.

Their move may also make Hezbollah increasingly responsible in the eyes of protestors. This is new ground for the party, which has generally left the administration of government to another Shiite party, Amal, as it concentrates on running the Islamic Resistance, the fighting force with which it has both resisted Israeli invasions, most recently in 2006, and supported president Bashar al-Assad in the war in neighboring Syria.

The banks are understandably nervous. As weeks of negotiations stretched out over the formation of the Diab government, Riad Salameh, the central bank governor, floated a plan on January 12 to Bloomberg for the $1.2 billion Eurobond maturing in March to be renegotiated “voluntarily” with Lebanese banks, who reportedly hold 40 percent of it. Salameh also said the central bank would waive interest payments on Treasury Bills for 2020, saving the government a lira equivalent of $1.9 billion.

Lebanon’s banks, which hold the bulk of both dollar as well as lira debt, have been trapped by their own reliance on high interest rates to attract the deposits with which they have financed the government deficit. But the banks have long argued that the root cause of Lebanon’s problems is government’s overspending, which has stymied the private sector and hampered growth.

“Lebanon cannot sustain its monetary and financial stability with a 150 percent debt to GDP ratio, the third highest worldwide and a fiscal deficit to GDP of 8 percent,” Marwan Barakat, chief economist at Audi Bank, tells me. “We believe that…a soft landing is still plausible if tough choices and measures are implemented…[including] spending austerity, improvement in resource mobilization, bridging the fiscal evasion gap, reforming the electricity sector and registering net savings in debt servicing pertaining to interest rate cuts.”

Others are less convinced, and advocate more drastic action, including default or a serious “hair cut” — the English phrase has entered common parlance — for bank depositors, shareholders, or both. Nasser Saidi, a former finance minister, has suggested that debt restructuring to extend maturities and reduce interest rates would require $20-$25 billion in foreign assistance. In his Bloomberg interview, Salameh appeared to reject a suggestion from Samir el-Daher, a Lebanese former World Bank official, of a one-time graduated “national solidarity tax” to raise $12-$30 billion.

In any case, such proposals float on the periphery of a vacuum. Other than mouthing platitudes on reform and tackling corruption, few politicians seem engaged. There is a sense of unreality alongside the rising anger at both politicians and banks.

Some Lebanese have given up listening to the news, while others avidly follow the latest on social media or the radio. There is much talk of rising prices, and some speculation over unlikely scenarios like an Egyptian-style military takeover. Government employees wonder about getting paid in the coming months, their existing salaries already worth far less in the shops.

Meanwhile, the fiscal crisis deepens as people refuse to pay bills from the loss-making state electricity utility, and as tax yields fall with a growing economic down-turn. On Mar Elias street, no-one is even feeding the parking meters.