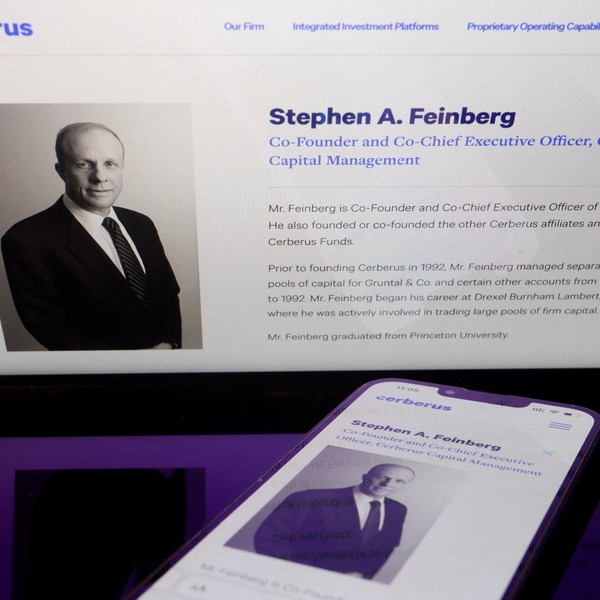

Private equity firms are rapidly acquiring a greater share of the U.S. defense sector, raising concerns about transparency as global demand for American weapons hits record highs, according to new research from the Stockholm International Peace Research Institute (SIPRI).

In 2021 alone, private equity funds invested $15 billion in nearly 140 defense-related deals. Firms have acquired some of the world’s largest defense contractors, including Amentum, which claims that it is the second leading provider of services to the U.S. government. (Just last month, Amentum won a $4.7 billion contract with the Air Force.)

Since private funds are not required to share information about their portfolio companies, contractors often “disappear into a black box” after an acquisition, according to SIPRI researchers Lorenzo Scarazzato and Madison Lipson.

“We’re not able to publish data regarding those companies,” Scarazzato said, noting that the “rising trend” of private equity takeovers could make it difficult for SIPRI to maintain its widely-cited list of the world’s largest defense firms. “In a way, our database becomes crippled by the trend.”

And, experts argue, the problems don’t stop there. The risky approach favored by private equity firms increases the chance that contractors could default on their loans, as happened to Constellis Holdings — the successor to Erik Prince’s Blackwater — in 2020. Private equity acquisitions are also a key driver of defense industry consolidation, which could lead to increased costs for taxpayers, according to a recent Pentagon report.

President Joe Biden recently requested $842 billion for next year’s defense budget, over half of which will go to contractors.

Private equity interest in defense companies began in the 2000s, when simultaneous large-scale wars in Iraq and Afghanistan signaled to investors that weapons companies were a safe long-term bet. These deals dropped off briefly in the early 2010s before jumping to new peaks during President Donald Trump’s tenure in office. In 2019, private equity firms carried out 42 percent of total defense contractor takeovers.

Private equity firms now own a controlling stake in AM General, which produces military Humvees and Hummer cars, and Navistar Defense, a leading producer of MRAP armored vehicles.

With demand for arms at record highs, investor excitement has continued to grow. Consultancy firm KPMG argued in a 2021 report that, due to factors like “increased global insecurity” and the covid pandemic, “now is perhaps one of the best times” to invest in defense companies.

As KPMG noted, investors have so far shied away from weapons makers, largely because of ethical investment restrictions from major funders like university endowments. But those concerns don’t apply to contractors who work in “cyber defense and surveillance, which will help to remove such reputational barriers to investment.”

In a 2020 paper, researchers Charles Mahoney, Benjamin Tkach, and Craig Rethmeyer found that private equity takeovers “frequently result in credit downgrades to acquired defense contractors,” making it more likely that companies will default on loans.

They attribute this to the fact that private enterprises are not obligated to share key information about their financial status, shielding them from public scrutiny. By contrast, publicly owned contractors who take big risks “are likely to suffer repercussions including a decrease in share price, negative publicity, and potential management shake-ups.”

“[I]ncreasing the level of financial risk among defense contractors heightens the probability of disruptive credit events that could hinder US national security activities,” the scholars concluded.